Artificial intelligence has long been viewed as a hobby of the scientific community – a narcissistic attempt to play divine and recreate life in our image. While intelligent robots have shown some use in industry and are undoubtedly a novel addition to daily life, they have seldom been considered vital.

However, it is now becoming increasingly evident that AI is not simply a benefit to some industries but a necessity. According to Deltec Bank, Bahamas – “The financial sector is growing so fast that technology is struggling to keep up, especially in the areas of identity verification, cybersecurity, and customer service. AI has proven highly successful in these areas for mitigating risk, streamlining processes, and improving efficiency.”

The challenge of legacy banking

Traditional banks are held back by legacy systems that often cannot be replaced or upgraded, opening the floodgates for modern digital banks to step in and take the reigns. To meet this demand, many big banks are now looking to AI to help catapult their aging technology into the 21st century.

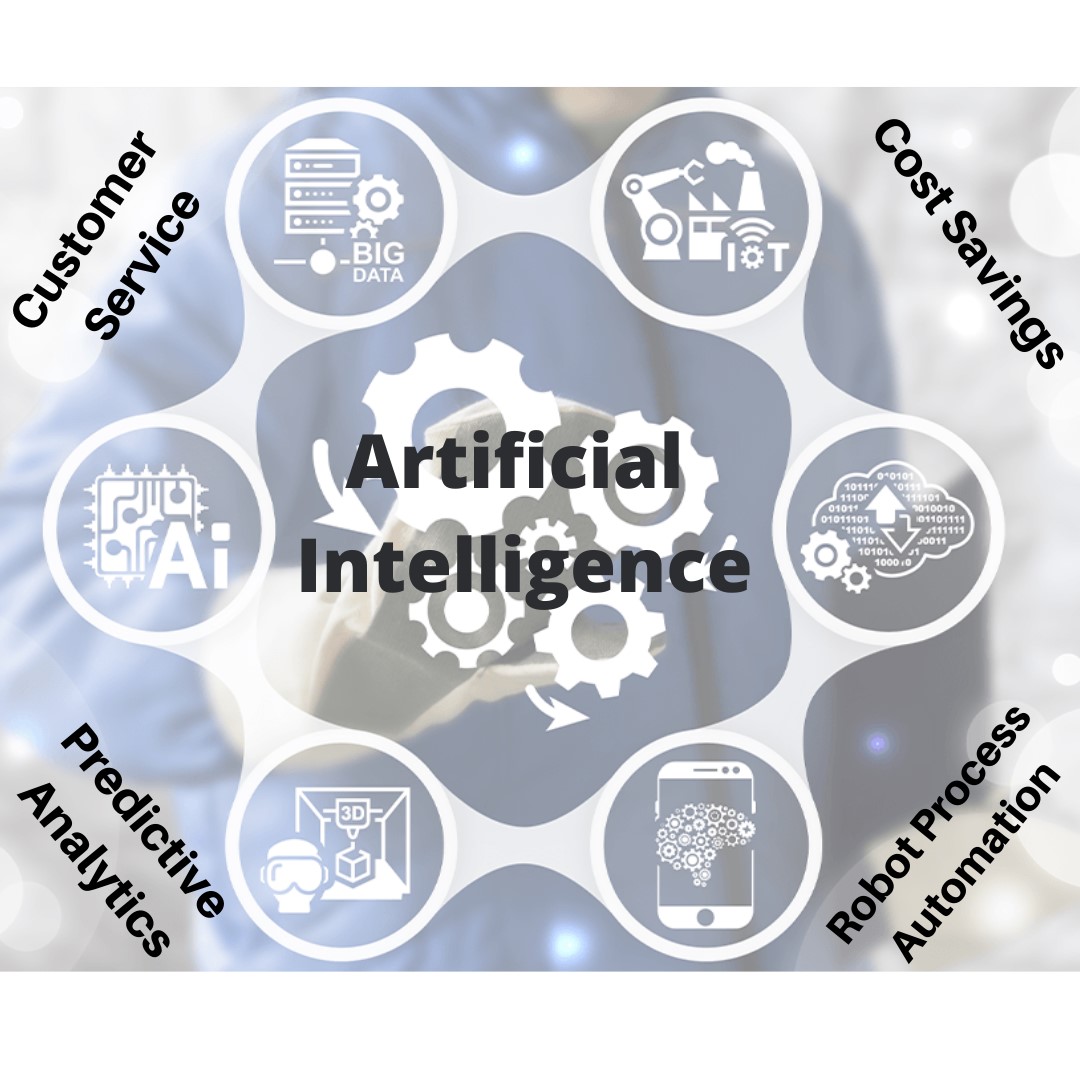

Robotic Process Automation (RPA) is exactly what it sounds like: automating a process using a robot. When banks are unable to port a legacy process into a modern computer program they use AI-assisted robots to automate it. RPA is somewhat of a stop-gap that is needed in order to continue operations until a more modern system can take over completely.

RPA systems utilize machine learning in combination with AI to constantly adapt to changes and make informed decisions without the need for costly human intervention. The U.S. tech conglomerate IBM is currently one of the leading developers of RPA systems.

Money, money, money

The incredible cost savings offered by AI recently became one of the biggest threats to traditional banks. When digital banks hit the scene several years back they were able to offer much cheaper financial products. The big banks came under fire as customers left in droves to join the new wave of low-fee, online-only, digital banks.

How did they achieve this? Using AI, digital banks found that they could sign up new customers, verify identity, and approve new loans, all online and without human oversight. Not only that but they could do so while offering equally good service, negating the need for any bank branches or the associated staffing costs.

Traditional banks have now begun to leverage AI for similar purposes, recognizing the necessity to meet this demand or risk losing even more business.

Predictive analytics

The true power of AI is often found in its ability to do what humans do, only much faster and in much greater quantity. When given access to the right data and information, AI can be trusted to accurately predict scenarios and make informed decisions.

This is predictive analytics, and it’s the driving force behind many financial processes including applicant approvals, fraud detection, and risk mitigation. The electronics giant Hitachi uses Microsoft’s Azure platform to develop predictive analytics systems for the financial industry.

AI’s ability to perform predictive analytics helps to drastically reduce the time required to perform these tasks manually. The cost savings alone are obvious but beyond that, AI shows evidence of better decision making with less error potential.

Customer service

All bank branches and personal service become a thing of the past, the need for better online customer service becomes paramount. Pre-recorded answerphone messages are the bane of any customer’s existence and call waiting times are only getting longer.

Businesses can no longer rely on automated answering systems to satisfy their customers nor can they afford the staffing costs required to answer each call. AI-enhanced customer service has come a long way and will soon be indistinguishable from a human being.

Using big data combined with the information made available via open banking protocols, AI will soon be able to listen to a customer, analyze their query, and provide them with whatever service they need.

Conclusion

The level of work required to compete in today’s financial environment is beyond the scope of a traditional human workforce. As digital banking evolves and becomes the first choice of young, upcoming individuals and businesses, traditional banks need to adopt AI to survive.

Artificial intelligence not only streamlines processes and improves efficiency, but opens up new avenues for developing advanced financial products. As the world hurtles into the 21st century, it is imperative that the banking industry fully utilizes the power of AI or risks being left behind.

Disclaimer: The author of this text, Robin Trehan, has an undergraduate degree in Economics, Masters in international business and finance, and an MBA in electronic business. Trehan is Senior VP at Deltec International www.deltecbank.com. The views, thoughts, and opinions expressed in this text are solely the views of the author, and not necessarily reflecting the views of Deltec International Group, its subsidiaries, and/or employees.

About Deltec Bank

Headquartered in The Bahamas, Deltec is an independent financial services group that delivers bespoke solutions to meet clients’ unique needs. The Deltec group of companies includes Deltec Bank & Trust Limited, Deltec Fund Services Limited, and Deltec Investment Advisers Limited, Deltec Securities Ltd. and Long Cay Captive Management.

Media Contact

Company Name: Deltec International Group

Contact Person: Media Manager

Email: Send Email

Phone: 242 302 4100

Country: Bahamas

Website: https://www.deltecbank.com/