The global Electric Off-Highway Vehicle Market size in a pre-COVID-19 situation was projected to reach USD 8.8 billion in 2020 from USD 21.7 billion by 2025 (in terms of value). However, due to COVID-19, most of the OEMs have delayed new vehicle developments and launches. Considering the global financial slowdown, electric off-highway vehicle manufacturers will refrain from adding extra cost to vehicles like an electric dump truck, electric LHD, electric excavator, electric loader, electric dozer, electric lawnmower, and electric tractor by installing batteries and hybrid powertrain systems.

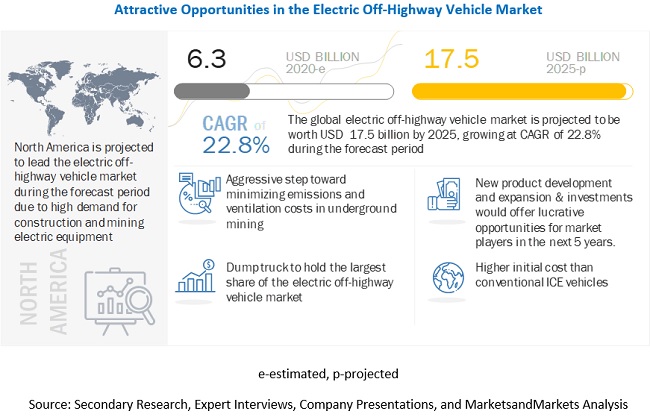

The electric off-highway vehicle market is estimated to observe a decline post-COVID-19 due to the impact on vehicle sales and demand from the application industry. The global electric off-highway vehicle market size post-COVID-19 is estimated to be USD 6.3 billion in 2020 and projected to reach USD 17.5 billion by 2025, at a CAGR of 22.8%, driven by the upcoming emission norms for off-highway vehicles, development of new and advanced products, and recovery of end-use sectors post-2020.

Construction equipment generally refers to heavy machinery that performs specific construction or demolition work and includes an electric excavator, electric loader, and electric dozer. These equipment are transportable, semi-permanent, or permanent and are primarily used for earthmoving, lifting containers or materials, drilling holes in earth or rock, and concrete and paving applications. Emission and noise regulations in urban or closed construction areas have a significant impact on the market for construction equipment. Growing environmental concerns and awareness of the harmful effects of vehicular emissions of off-highway vehicles have forced OEMs to focus on the electrification of construction equipment.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=129288251

The demand for the electrically-propelled loader is increasing in North America and Europe. Many American and European companies are investing in the development of electric loaders. For instance, in April 2019, one of the leading construction equipment manufacturers, Caterpillar, launched the concept 906 compact wheel loader. The concept of 906 loader is developed with a fully electric drive train powered by a lithium-ion battery. Moreover, the Volvo CE has already announced that it will stop making diesel versions of some compact excavators and wheel loaders by mid-2020.

Major companies are adopting the expansion strategy to gain traction in the electric off-highway vehicle market. For instance, in 2019, Hitachi Construction Machinery announced the establishment of a new headquarters in New South Wales, Australia, to strengthen its business in the region and further expand its construction machinery sales as well as parts and service business.

Asia Pacific, with high electrification trend in developed countries and high demand for construction and mining equipment, is projected to grow at the CAGR of 30.5%. Considering the fact that China is the world leader in the electrification of on- and off-highway vehicles with ample availability of charging infrastructure and aftermarket services, it accounts for the largest share of the electric off-highway vehicle market in Asia Pacific. The Chinese government’s support in developing infrastructural projects and increasing demand for electric construction vehicles in countries such as Japan and South Korea are major drivers for this market. Furthermore, the continuously increasing demand for mining automation from countries such as China, Indonesia, and Australia are expected to further drive the demand for electric off-highway vehicles like electric dump truck and electric LHD in Asia Pacific.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=129288251

Key Market Players

The electric off-highway vehicle market is dominated by a few globally established players such as Caterpillar (US), Komatsu Ltd. (Japan), Hitachi Construction Machinery (Japan), Volvo Construction Equipment (Volvo CE) (Sweden), Epiroc (Sweden), and Sandvik (Sweden).

COVID-19 IMPACT

The global off-highway industry is projected to witness a downturn of –3.3% in 2020 owing to the COVID-19 pandemic. The COVID-19 pandemic has affected the heavy equipment (including off-highway equipment) industry significantly as some manufacturers are shutting down plant operations while others are considering using their efforts to cater to the demand for medical supplies. As lockdowns are implemented across the globe to contain the spreads of the disease, construction, and mining projects are significantly affected. Scheduled projects are anticipated to be delayed, which is likely to affect the sales of equipment, coupled with the demand for frequently replaced products like lubricants from existing fleets. Key players in the market are aware that when the market reopens, the production levels will reduce in order to adhere to safety measures. Moreover, the spending of customers whose business is affected due to the pandemic will be low.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=129288251

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/off-highway-electric-vehicle-market-129288251.html