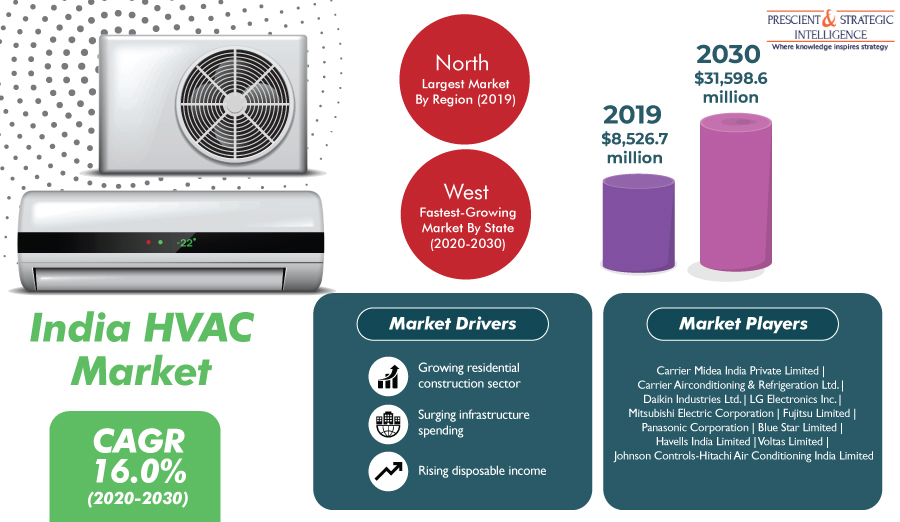

The Indian HVAC market will grow at a CAGR of 16.0% during the forecast period (2020–2030), due to the increasing disposable income of people and rising investments for infrastructural development in the commercial, residential, and industrial sectors of the country. The market generated revenue of $8,526.7 million in 2019 and it is projected to reach $31,598.6 million by 2030. Moreover, the strengthening real estate sector, on account of rapid urbanization and robust government support, and the booming population act as catalysts for the market growth.

One of the key factors behind the India HVAC market growth is the expansion of the residential construction sector in the nation. The country is observing a rise in urbanization rate, an improvement in real estate regulations, and a surge in government-initiated residential plans. The Government of India’s initiative to create 100 smart cities will act as a vital factor behind the residential construction sector growth. The newly constructed housing units are creating extensive demand for air conditioners, heat pumps, and ventilation systems.

Request for sample copy of this report: https://www.psmarketresearch.com/market-analysis/india-hvac-market/report-sample

Moreover, increasing number of construction activities in the commercial and civic infrastructure sector will also boost the Indian HVAC market growth in the forecast years. For instance, the Delhi Metro Rail Corporation Limited (DMRC) was sanctioned with $57 million to expand Ghaziabad and Noida metro lines. Similarly, a budget of $925 million was allotted for the construction of Dahisar–Mira Bhayander and Andheri–Chhatrapati Shivaji Maharaj International Airport lines of Mumbai Metro. Likewise, in 2017, the Indian government announced the construction of 100 airports in the next 15 years.

Currently, the Indian HVAC market is observing a trend of rising adoption of energy-efficient equipment. Owing to the surging environmental concerns in the nation, the preference for fuel-efficient and energy-efficient HVAC equipment has increased significantly. These systems offer better or same efficiency than the conventional variants. In 2018, the central government introduced a new Energy Conservation Building Code (ECBC) and Eco-Niwas Samhita for residential units. These initiatives aim to cut down the annual electricity consumption of India by about 125 billion units by 2030.

The offering segment of the Indian HVAC market is bifurcated into equipment and service. The equipment category is further classified into heating, ventilation, and cooling. Among these, the cooling category accounted for the largest share in 2019, owing to the sub-tropical climate of the nation. All the sub-Himalayan regions of the country witness hot and humid weather during most of the months, due to the sub-tropical climatic condition. Moreover, surging urbanization and rising disposable income of the people have fueled the demand for air conditioners in India.

Browse detailed report on India HVAC Market By Offering, End-User and Industry Forecast to 2030

Currently, the northern part of the country generates the highest revenue due to the varying climatic conditions. The states of Rajasthan, Punjab, Haryana, Delhi, Uttar Pradesh, and Madhya Pradesh have a predominantly hot climate; whereas, Himachal Pradesh, Uttarakhand, Ladakh, and Jammu and Kashmir have long and freezing winter. The hot states of North India are installing cooling equipment; whereas, cooler states are adopting heating equipment. However, the market in West India will display the highest growth in the foreseeable future, owing to the presence of major manufacturing hubs in Pune, Ahmedabad, Nagpur, and Mumbai.

Thus, the expansion of the residential and commercial construction sector will boost the market growth in the coming years.

India HVAC Market Size Breakdown by Segment

By Offering

- Equipment

- Heating

- Heat pump

- Air-source

- Water-source

- Ground-source

- Furnace

- Gasoline

- Propane

- Electric

- Boiler

- Water-tube

- Fire-tube

- Unitary heater

- Ventilation

- Ventilation fan

- Centrifugal fan

- Axial fan

- Domestic exhaust fan

- Power roof fan

- Air handling unit and fan coil unit

- Air handling unit

- Terminal units

- Makeup air units

- Rooftop units

- Fan Coil Units

- Two-pipe

- Four-pipe

- Humidifier/dehumidifier

- Air cleaner

- Type 1: HEPA + Carbon

- Type 2: HEPA + Carbon + Ionizer

- Type 3: HEPA + Carbon + ultraviolet (UV)

- Type 4: HEPA + Carbon + Ionizer+ UV

- Type 5: Other Technologies

- Cooling

- Room AC

- Mini split

- Window AC

- Split unit

- Ducted split/packaged unit

- Packaged unit with water-cooled condenser

- Packaged unit with air-cooled condenser

- Variable refrigerant flow (VRF)

- Heat pump system

- Heat recovery system

- Chiller

- Centrifugal

- Screw

- Scroll

- Absorption

- Reciprocating

- Service

- Upgradation/replacement

- Maintenance and repair

- Installation

- Consulting

By End-User

- Commercial

- Office and building

- Hospitality

- Transportation

- Supermarket/hypermarket

- Healthcare

- Government

- Industrial

- Food and beverage

- Oil and gas

- Automotive

- Energy and utilities

- Residential

By Region

- South India

- West India

- North India

- East India

Browse Other Related Reports

HVAC Market in Saudi Arabia – As per P&S Intelligence, the rampant construction activities will likely take the Saudi Arabian heating, ventilation, and air conditioning market value from $2,476.1 million in 2020 to $4,821.8 million in 2030, at an 8.1% CAGR between 2021 and 2030.

HVAC Services Market in U.S. – Geographically, the southern region accounted for the largest share in the U.S. HVAC services market in 2019, owing to the varying climatic conditions of the southern cities. Additionally, the accelerating urbanization rate in the region is also driving the demand for HVAC systems there.

Media Contact

Company Name: P&S Intelligence

Contact Person: Abhishek

Email: Send Email

Phone: +918887787886

Address:Noida Sector 2

City: Noida

State: UP

Country: India

Website: https://www.psmarketresearch.com/market-analysis/india-hvac-market