The global electric vehicle charging infrastructure market size was valued at USD 19.26 billion in 2021 and is expected to reach USD 217.06 billion by 2030 growing at a CAGR of 30.6% during the forecast period.

The rising levels of carbon emissions and other harmful gases stemming from transportation have triggered the necessity of adopting electric vehicles. Hence, the demand for an Electric Vehicle (EV) charging infrastructure in commercial and residential applications is on the rise. Moreover, increasing partnerships among car manufacturers for charging facilities by providing a subscription model is further expected to drive the market growth.

Gather more insights about the market drivers, restrains and growth of the Global Electric Vehicle Charging Infrastructure Market

The technological progress of both electric vehicle charging software and hardware is expected to change the way EV owners use and benefit from electric vehicle charging applications. Technologies such as Smartcar API and charging networks precisely determine an electric vehicle’s charge time even before the car driver plugs the car into a station.

Additionally, green energy is expected to play a significant role in both public and residential electric vehicle charging spaces. EV owners are majorly concerned about carbon emissions. To address these concerns, companies are making rapid advancements in the charging technologies of their electric vehicle charging networks.

The market penetration of EV charging equipment is significantly high in commercial spaces as compared to residential places. The number of commercial charging stations is predicted to increase in line with the growing adoption of electric vehicles. Efforts toward strengthening the charging infrastructure in commercial spaces would be decisive in encouraging the adoption of EV, as overnight charging at residential complexes or individual homes would not be sufficient for long-distance journeys.

Moreover, public charging infrastructure would also facilitate the ultra-fast charging capabilities necessary for long-distance journeys. However, EV chargers for residential spaces can also offer significant growth potential as they provide a cheaper and more convenient mode for charging electric vehicles as compared to commercial charging stations.

EVCI manufacturers are collaborating with the car rental service to integrate chargers into the existing infrastructure. For instance, In January 2020, Eaton announced its partnership with Green Motion car rental service provider to provide integrated chargers into the building with energy storage. Various automotive manufacturers, such as Volkswagen Group, BMW Group, and General Motors, among others, are investing in the development of Car2X technology for charging infrastructure which is further driving the growth.

Countries such as France, India, the Netherlands, and Canada have introduced several campaigns to boost the adoption of electric vehicles. However, due to the COVID-19 outbreak, the global automobile industry is expected to face a slowdown as several countries across the globe have restricted the production of EVs. This is expected to adversely impact the electric vehicle charging infrastructure market.

As governments across the globe are focusing on emerging from the pandemic with a stronger and more resilient economy, EVs are expected to continue to gain significant attention. For instance, in the U.S., California is emerging with strong electric vehicle targets, which is expected to have a positive impact post-pandemic and boost the growth of the market.

Electric Vehicle Charging Infrastructure Market Segmentation

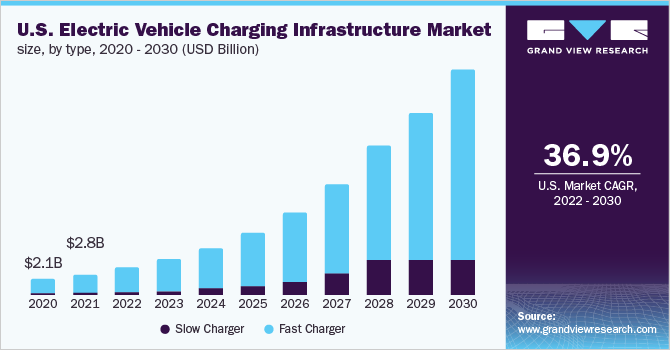

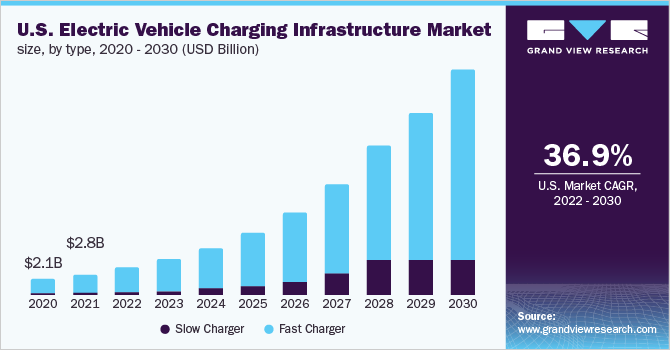

Based on the, Charger Type Insights the market is segmented into Slow and Fast

- The fast charger segment led the market and accounted for more than 93.0% share of the global revenue in 2021, attributed to the increasing demand for its deployment in commercial stations. Besides, automotive manufacturers are emphasizing the installation of electric vehicle charging stations for their employees as part of the efforts to raise awareness about their electric cars.

- The slow charger segment accounted for a significant share of the market in 2021 owing to the initiatives by various governments for accelerating the deployment of public charging infrastructure, which mostly employs slow chargers.

Based on the Connector Insights the market is segmented into CHAdeMO, (CCS) and Others

- The CHAdeMO segment dominated the market and accounted for more than a 17% share of the global revenue in 2021. This is primarily due to its compatibility with a majority of electric vehicles (including BMW, GM, and VW, among other models) and the convenience of handling it.

- The CCS segment is expected to grow at the highest CAGR over the forecast period owing to increased preference by major automobile manufacturers for the adoption of CCS connectors in their EVs.

Based on the Application Insights the market is segmented into Commercial and Residential

- The commercial segment accounted for a revenue share of 84% in 2021 owing to the initiatives and allocation of funding by the governments and automobile manufacturers for expanding public EVCI infrastructure.

- Vehicle charger manufacturers are focusing on developing residential and commercial EV chargers to ensure higher availability and increased vehicle range.

Based on the Regional Insights the market is segmented into North America, Europe, and Asia Pacific

- Asia Pacific dominated the market and accounted for more than a 59% share of the global revenue in 2021. Countries such as China, Japan, and South Korea are the hub of electric vehicles that heavily investing in the development of charging infrastructure.

- Various European countries have set ambitious targets for curbing carbon emissions and electric car stock commitments by 2020.

Market Share Insights

- July 2019: Tesla announced the introduction of a CCS connector to support Model 3, with expected near future compatibility with Model S and Model X in Europe.

- July 2018: The U.K. government passed the Automated and Electric Vehicles (AEV) Act. It provides the government with new powers to ensure the rapid development of EVCI on motorways and fuel stations.

Key Companies Profile:

The market players are continuously working on new product developments and upgrades of their existing product portfolio. For strategic growth, these players prefer collaborations with other EV manufacturers.

Some prominent players in the global electric vehicle charging infrastructure market include:

- AeroVironment, Inc.

- ABB

- BP Chargemaster

- ChargePoint, Inc.

- ClipperCreek, Inc.

- Eaton Corp.

- General Electric Company

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Schneider Electric

- Siemens AG

- Tesla, Inc.

Order a free sample PDF of the Electric Vehicle Charging Infrastructure Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/electric-vehicle-charger-and-charging-station-market