System Integration Industry Overview

The global system integration market size was valued at USD 327.70 billion in 2021 and is expected to reach 955.21 billion by 2030, expanding at a CAGR of 13.2% over the forecast period. The rising advancements in cloud technologies, increasing use of the Internet of Things (IoT), and rising investment in distributed information technology systems (telecommunication networks and real-time process control), are a few factors contributing to the growth of this industry. The COVID-19 outbreak has thrown light on weakness in business models across verticals. However, it has offered several opportunities to digitize and expand the business across regions by adopting technologies such as cloud, Artificial Intelligence (AI), and IoT. With the considerable control achieved over the pandemic, various sectors such as retail, manufacturing, and automotive, are expected to witness rising investments as system integration solutions grow in prominence across different business functions.

With the increasing customer base and expansion of new regions and markets, organizations face many challenges dealing with rapidly growing data sources. The advent of big data technology offers benefits to organizations in implementing big data with full potential, which includes data integration. Moreover, organizations require advanced data integration tools to combine the information silos, which help get valuable business insights. These advanced tools are equipped with novel features, such as data capture, data profiling, and metadata management, to process data post-integration, resulting in smooth and reliable data extraction. These tools have resulted in increased demand for reduced complexity of business processes and creating opportunities for the market.

Gather more insights about the market drivers, restrains and growth of the Global System Integration market

The rising consumer inclination towards virtualization is also anticipated to be one of the key driving factors for the growth in the market. Virtualization ensures the simultaneous execution of multiple applications and enables a user to perform various other tasks at the same time on the same server. It reduces additional IT operating costs and ensures increased computer hardware utilization, flexibility, and efficiency. Furthermore, data virtualization software provides the idea of a database, where the data is to be stored and integrated. Therefore, several companies are considering the integration of their data and adopting virtualization technologies to procure added advantages.

The increasing adoption of cloud computing, rapid growth of sSmall & Medium Enterprises (SMEs), and the demand for low-cost and energy-efficient production processes is driving the product adoption. Moreover, several companies are developing softwares to provide asset management solutions for IT infrastructure management. For instance, in September 2020, Automated Logic announced a partnership with Nlyte Software, a Data Center Infrastructure Management (DCIM) software provider, to introduce an Integrated Data Center Management (IDCM) solution. This integration is expected to help data center customers to enable additional energy savings, improve uptime, and reduce costs. This increase in adoption of cloud data integration platforms among different industry verticals is expected to bolster the system integration market in the times to come.

Increasing need to integrate data and services in private clouds has boosted the demand for system integration. Cloud-based solutions are ideal for organizations as they help them use their resources in an optimum manner and save them the cost of installing physical network systems. They help bring out the maximum productivity of the organization. These solutions are gaining immense popularity among end-users as they help in the smooth streamlining of processes and execution of different strategies in a cost-effective manner.

System Integration Market Segmentation

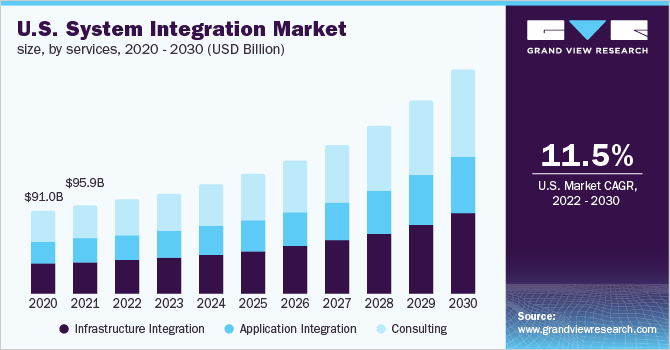

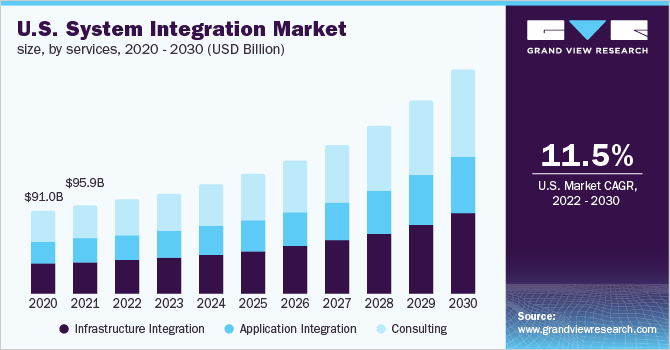

Based on the Services Insights, the market is segmented into Infrastructure Integration, Application Integration, and Consulting.

- The infrastructure integration segment accounted for a market share of over 35% in 2021. The segment growth can be attributed to the need for converged Information and Communication Technology (ICT) infrastructure and enhanced business process efficiency.

- The application integration segment is expected to grow at a significant CAGR of 12.4%. The trend of cloud applications in the IT industry is predicted to drive the segment’s growth.

Based on the End-use Insights, the market is segmented into IT & Telecom, Defense & Security, BFSI, Oil & Gas, Healthcare, Transportation, Retail, and Others.

- The Banking, Financial Services, and Insurance (BFSI) segment held a market share of over 15% in 2021. The digitization in the BFSI sector is likely to drive demand for high-quality system integration services.

- The healthcare segment is anticipated to grow at a significant CAGR of 12.0% over the forecast period. The segment growth can be attributed to the increased use of connected care technologies during the COVID-19 pandemic and the rapid adoption of Electronic Health Records (EHR).

Based on the System Integration Regional Insights, the market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- North America held a market share of over 35% in 2021 owing to the rising use of IoT in industrial automation and the growing adoption of cloud-based services among SMEs and large organizations.

- Asia Pacific is anticipated to rise as the fastest developing regional market at a CAGR of 14.9% supported bythe rapid growth of the Asian economies resulting in increased investments in systems integration.

Market Share Insights:

- February 2022: Accenture implemented a cloud-based core IT platform for Astellas Pharma Inc., a multinational pharmaceutical company that provides advanced and data-driven management models for the company’s global operations.

- September 2020: Wood partnered with Aspen Technology, Inc. so that the latter can offer Wood’s clients Aspen Mtell asset performance management (APM) technology for predictive and prescriptive maintenance.

Key Companies Profile:

Market players are focusing on investing in resources in research & development activities to support growth and enhance their internal business operations. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. Some of the prominent players operating in the global system integration market include:

- Accenture

- Capgemini

- Oracle Corporation

- Cisco Systems, Inc.

- Cognizant

- Deloitte Touche Tohmatsu Limited

- International Business Machines Corporation

- Infosys Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

Order a free sample PDF of the System Integration Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/system-integration-market