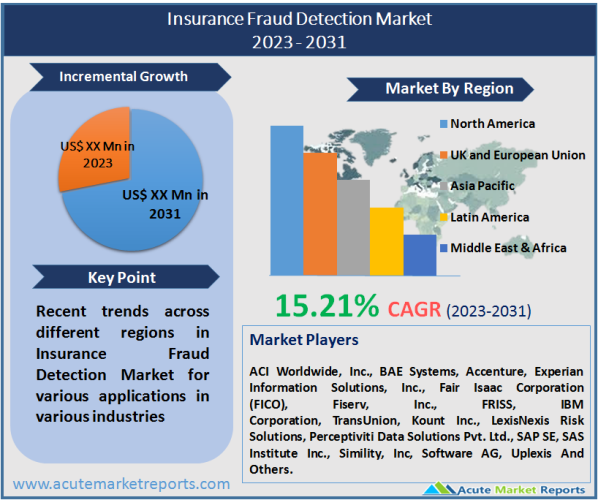

Analysts expect that the global market for insurance fraud detection will expand at a CAGR of 15.21% between 2023 and 2031. Due to the quick adoption of insurance fraud detection technology by businesses in this area, North America is expected to have the biggest market size for insurance fraud detection and to hold the largest market share over the projected period. Throughout the projection period, the existence of a significant number of insurance fraud detection solutions and service providers in this area is also anticipated to boost market expansion. In addition, the increase in threats and vulnerabilities, as well as government regulations, are anticipated to boost the industry. Increasing awareness about the benefits of insurance fraud detection solutions among small and medium enterprises as well as large enterprises to prevent various types of fraud such as payment fraud, identity theft, and claim fraud is expected to drive market growth in the Asia-Pacific region.

The proliferation of cyberattacks, the stratospheric number of identities that enterprises must maintain, and the significant financial losses that have occurred from attacks on the insurance industry are all elements propelling the market’s growth. For instance, according to the Federal Bureau of Investigation, insurance fraud is the second most prevalent type of white-collar crime in the United States and is responsible for nearly $300 million in annual losses.

The expanding usage of technology, such as artificial intelligence, machine learning, and blockchain, in the banking, financial services, and insurance (BFSI) industry has created tremendous data security concerns. In addition, as this sector of the economy becomes increasingly digitized, the occurrence of cyberattacks and thefts is raising the demand for data protection in the BFSI security industry. In addition, financial institutions such as banks, financial institutions, and other financing organizations are fast transitioning to a digital business model. This has resulted in dramatic growth in the adoption and implementation of diverse security solutions and services.

Browse for the report at: https://www.acutemarketreports.com/report/insurance-fraud-detection-market

Due to its susceptibility to external as well as internal security risks, the BFSI industry employs a variety of security solutions and services. BFSI security organizations, on the other hand, are often third-party service providers that offer security solutions to several clients and industry verticals simultaneously. In addition, this may make it difficult for firms to manage data originating from multiple companies. As a result, concerns with relying on security solutions and services, as well as the possibility of involving third parties, both of which could result in the disclosure of sensitive data, limit the industry’s growth.

On the basis of the offered solutions, the market can be divided into various areas, including authentication, fraud analytics, governance, risk, and compliance. In 2022, the authentication solution sector generated the largest proportion of the market’s overall revenue. Insurance companies no longer employ the manual handling of cases of insurance fraud. The development of new technologies, such as data analytics for fraud detection, has emerged as one of the most essential instruments used by businesses to address the threats and challenges posed by the growing fraud ecosystem. Integrating data from multiple sources permits the creation of very effective fraud detection capabilities. In addition, analytics have played a crucial role in the process of merging internal data with external data, which has resulted in enhanced fraud detection capabilities. Using techniques such as predictive modeling, the adoption of analytics has considerably improved the effectiveness of fraud detection. As a result, the organization has been able to investigate a range of fraud cases, limit possible reasons, and identify low-incidence fraud situations in order to undertake a more thorough inquiry.

The on-premises deployment category was the market’s primary driver in 2022. With the help of the on-premises fraud detection tools, the organization is able to detect and report possible fraudulent activities in real-time. The suppliers give either a rule-based method or a predictive behavioral scoring model, or both, for recognizing harmful tendencies. Despite the existence of automated technologies, the organization still needs human involvement in order to examine some reports accurately. Thus, on-premises solutions, as opposed to cloud-based services, are the predominant reliance of organizations.

Get a Free PDF Sample From https://www.acutemarketreports.com/request-free-sample/138872

North America held the lion’s share of the revenue pie in 2022, which was greater than 42%. The presence of key firms such as ACI Worldwide, Inc., BAE Systems, and Fiserv, Inc., among others, has aided the expansion of the region. Property, liability, and life annuities are the three key subsectors that comprise the insurance industry of the United States in the North American region. The government of the United States of America has made health and life insurance mandatory for its citizens. As a result, a tremendous market for the insurance sector was formed. As a result, there is a chance that vulnerabilities could be used for fraudulent operations such as claims processing. According to data conducted by the Federal Bureau of Investigation (FBI), the annual cost of insurance fraud in the United States is predicted to exceed USD 40 billion. This is predicted to give industry growth opportunities.

Throughout the period between 2023 and 2031, it is anticipated that the regional market in Asia-Pacific would see the highest CAGR, 18.67%. In an effort to tackle the huge problem of insurance fraud in the region, local firms have begun deploying cutting-edge technical solutions. In addition, an increase in expenditures on enhanced systems for claims administration and claims processing is anticipated to be a factor in regional economic expansion. This is done to ensure customer satisfaction and retention. It is expected that a greater awareness of fraud prevention approaches will enhance the demand for fraud prevention solutions.

The presence of multiple individual and global vendors of comprehensive insurance fraud detection solutions has led to a highly fragmented market. Accenture, ACI Worldwide, Inc., SAS Institute Inc., IBM Corporation, Fiserv, Inc., SAP SE, Experian Plc, BAE Systems, LexisNexis, Kount, FRISS, and FICO are some of the most significant firms in this market category. The expansion of small and medium-sized businesses offering customized solutions contributes to the industry’s second distinguishing characteristic, which is severe competition. In addition, it is projected that providers of fraud detection as a service would increase market competitiveness by providing comprehensive and cost-effective product offerings. As the incidence of fraudulent activities continues to represent a concern for the insurance industry, fraud detection firms are expected to seize the opportunity given by the ecosystem’s evolution. It is anticipated that the vendors would offer sophisticated solutions that address specific challenges, enabling insurers to implement a comprehensive fraud detection procedure.

Other Popular Reports: https://www.acutemarketreports.com/category/cybersecurity-market

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com