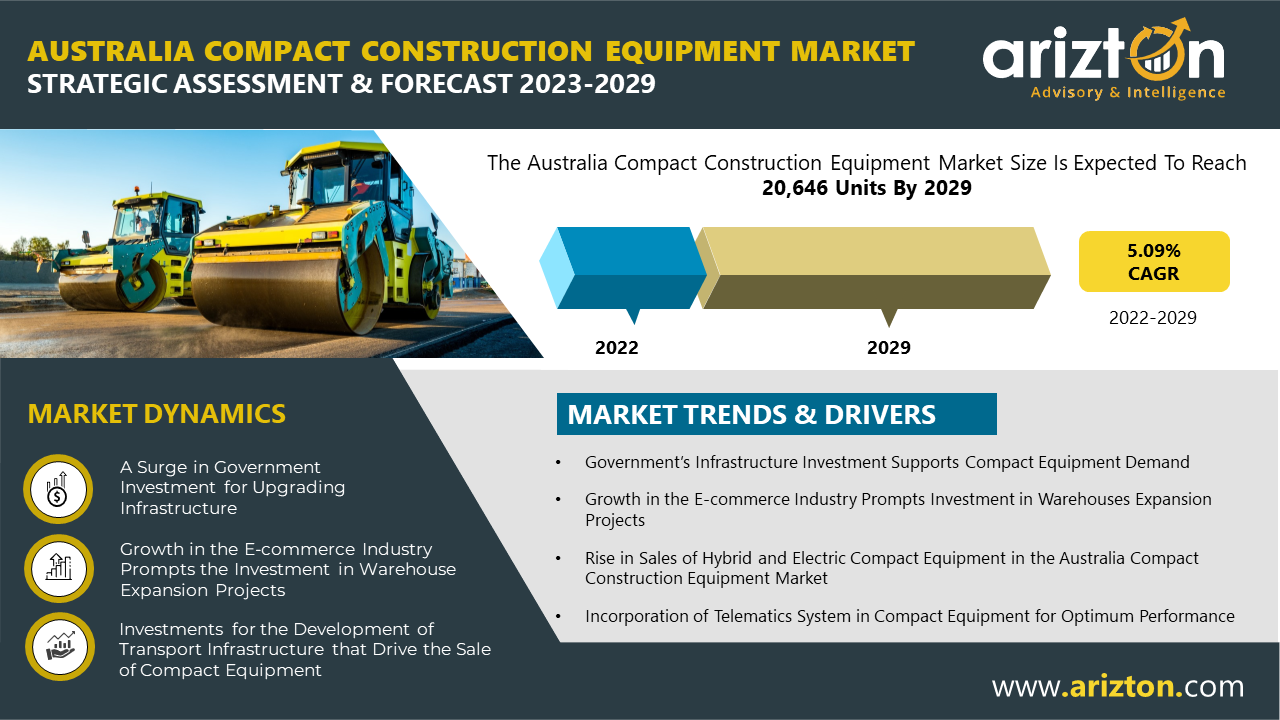

Arizton publishes the latest research report on Australia compact construction equipment market – strategic assessment & forecast 2023-2029. The market is growing at a CAGR of 5.09% during 2022-2029.

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/4045

Market Trends & Drivers

Growth in the E-Commerce Industry Prompts the Investment in Warehouse Expansion Projects

- Australia is one of the world’s largest e-commerce markets; e-commerce spending reached $50.2 billion in 2022, a 13% increase compared to 2021.

- NewCold logistics company, in December 2022, announced to invest $160.3 million to build its first warehouse in Sydney’s west. The construction is designed to take place in two phases. The first phase will include a frozen pallet warehouse with 80,000 pallets. In the second phase, warehouses will be constructed in Marsden Park Industrial in New South Wales.

- Woolworth (supermarket chain) announced its plans to construct two new automated warehouses at Moorebank Logistics Park in Western Sydney. The warehouses are anticipated to be operational by 2024.

- Construction on Axis Alexandria Warehouse in Sydney is underway, including the construction of a two-story, multi-unit warehouse and a distribution building on 1.69 hectares of land. The project, therefore, involves the construction of nine small warehouse units, parking facilities, and loading and unloading facilities.

- Demand for construction equipment used in warehouses, logistics, and distribution centers, such as forklifts, telehandlers, and scissor aerial platforms, is expected to rise in the upcoming years.

Rise in Sales of Hybrid and Electric Compact Equipment

- Australia’s Long-Term Emissions Reduction Plan aims to achieve net-zero emissions by 2050. Construction equipment manufacturers and companies increasingly know the government’s environmental regulations.

- In Australia, Volvo CE launched its new Volvo CE EC300E Hybrid Excavator in February 2023, an environmentally friendly option with improved fuel efficiency. The machine consumes less than 15% fuel and generates 15% less carbon emissions.

- In March 2023, Hitachi Construction Machinery announced that it would launch new wheel loaders and excavators from Australia’s popular ZW-7 and ZX-7 series. These machines are equipped with Stage V-compliant fuel-efficient engines. The excavator engines are made up of a Selective Catalytic Reduction (SCR) system, Diesel Oxidation Catalyst (DOC), and Catalyzed Soot Filter (CSF).

- Demand for hybrid and electric compact construction equipment is expected to rise during the forecast period in response to the strict government regulations.

Vendor Insights

- Caterpillar, Komatsu, Kubota, Hitachi Construction Machinery, and Volvo Construction Equipment are leaders in the Australia compact construction equipment market. These companies have a substantial market share and offer diverse sets of equipment.

- Manitou, Maximal, Kanga Loaders, Toyota Material Handling, Bobcat, CNH Industrials, & Mecalac are niche players in the Australia compact construction equipment market. These companies offer low product diversification and have a strong presence in the Australian local market.

- XCMG, Hyundai Construction Equipment, Takeuchi, SANY, Yanmar, JCB, Kobelco, John Deere, & LiuGong are emerging in the Australia compact construction equipment market.

- The emerging players are introducing new technologically advanced products to challenge the market share of market leaders in the Australian market.

- Hangcha, Task Forklift, and Yuchai have low product diversification; these companies are lagging in adopting modern technologies used in compact construction equipment in the region.

Australia Compact Construction Equipment Market Dynamics

Drivers

Surge in Government Investment for Upgrading Infrastructure

Growth in the E-commerce Industry Prompts the Investment in Warehouse Expansion Projects

Investments for the Development of Transport Infrastructure that Drive the Sale of Compact Equipment

Trends

Rise in Sales of Hybrid and Electric Compact Equipment

Incorporation of Telematics System in Compact Equipment for Optimum Performance

OEMs Launching Smart Construction Solutions for Optimized Performance

Challenges

Shortage of Labor Force Hampering Construction Projects

Surge in Housing Construction Cost Negatively Impact Housing Projects

Scarcity of Industrial Space May Hamper the Pace of Warehouse Development Projects

Opportunities

Water Management Projects

Incorporation of Digital Technology

Investment in lithium mining

Vendors

Prominent Vendors

- Caterpillar

- Komatsu

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Volvo Construction Equipment

- Hitachi Construction Machinery

- JCB

- SANY

- Kobelco

- Hyundai Construction Equipment

- Kubota

- Bobcat

Other Prominent Vendors

- John Deere

- Yanmar

- LiuGong

- Takeuchi

- Toyota Material Handling

- Manitou

- CNH Industrial

- Mecalac

- Kanga Loaders

- HYSOON AUSTRALIA PTY LTD.

- Yuchai

- Task Forklift

- Hangcha

- Maximal

- Ditch Witch

- Haulotte Group

- Faresin

Distributor Profiles

- CJD Equipment

- Semco Group

- Tutt Bryant

- Capital Construction Equipment

- BPF Equipment

- CEA

- Forklifts Australia

- Hitachi Construction Machinery Pty Ltd

Market Segmentation

Type

- Excavators

- Backhoe Loaders

- Wheeled Loaders

- Track Loaders

- Skid Steer Loaders

- Telehandlers

- Forklifts

- Aerial Platforms

- Others (Articulated Loaders, Truck Carriers)

Application

- Material Handling

- Maintenance & Utility Works

- Waste Management

- Other Applications

End Users

- Construction

- Mining

- Warehouse & Logistics

- Other (Maintenance & Utility Works, Landscaping, Power Generation)

Key Questions Answered in the Report

How big is the Australia compact construction equipment market?

What is the growth rate of the Australia compact construction equipment market?

Who are the key players in the Australian compact construction equipment market?

What are the trends in the Australian compact construction equipment industry?

Which are the major distributor companies in the Australian compact construction equipment market?

Check the detailed table of contents of the report @ https://www.arizton.com/market-reports/australia-compact-construction-equipment-market?details=tableOfContents

Why Arizton?

- 100% Customer Satisfaction

- 24×7 availability – we are always there when you need us

- 200+ Fortune 500 Companies trust Arizton’s report

- 80% of our reports are exclusive and first in the industry

- 100% more data and analysis

- 1500+ reports published till date

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/australia-compact-construction-equipment-market