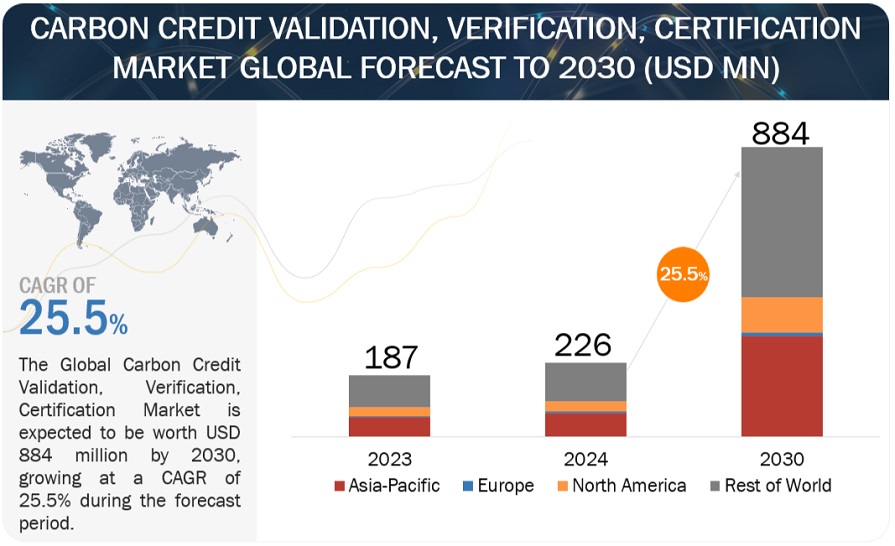

According to a research report “Carbon Credit Validation Verification and Certification Market by Type (Voluntary, Compliance), Service (Validation, Verification, Certification), End User (Energy & Utilities, Agriculture & Forestry, Industrial) & Region – Global Forecast to 2030″, the market size for global carbon credit validation, verification, certification is projected to reach approximately USD 884 million by the year 2030, as compared to the estimated value of USD 226 million in 2024, at a Compound Annual Growth Rate (CAGR) of 25.5% over the forecast period. The global carbon credit validation, verification, and certification market is driven by several key factors. Governments worldwide are implementing stringent environmental regulations and carbon pricing mechanisms to curb greenhouse gas emissions. These policies, such as the European Union Emissions Trading System (EU ETS) and California’s Cap-and-Trade Program, necessitate the validation, verification, and certification of carbon credits, ensuring that organizations meet their compliance obligations. Increasingly, corporations are adopting sustainability strategies to enhance their environmental credentials and meet stakeholder expectations. Companies are voluntarily purchasing carbon credits to offset their carbon footprints, driving demand for rigorous validation and verification processes to guarantee the credibility and impact of their investments in carbon reduction projects.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=229971770

Investors are increasingly prioritizing environmental, social, and governance (ESG) criteria in their investment decisions. This trend is propelling businesses to demonstrate their commitment to reducing carbon emissions through verified carbon credits. The emphasis on ESG performance fuels the demand for robust certification standards to ensure transparency and accountability. Innovations in technology, such as blockchain, remote sensing, and Geographic Information Systems (GIS), are enhancing the efficiency and accuracy of carbon credit validation and verification processes. These technologies facilitate real-time monitoring and reporting, making it easier to track emissions reductions and verify the authenticity of carbon credits, thereby boosting market confidence and adoption. International agreements like the Paris Agreement have set ambitious global targets for reducing greenhouse gas emissions. These agreements encourage countries to adopt carbon pricing mechanisms and promote the use of carbon credits as a tool for achieving national and international climate goals. This global commitment to climate action drives the need for reliable validation, verification, and certification systems to ensure the effectiveness of carbon markets.

Agriculture & Forestry segment, by Sector, to hold the second largest market in carbon credit validation, verification, certification.

Agriculture and forestry occupy a prominent position in the global carbon credit validation, verification, and certification market due to their substantial carbon sequestration capabilities and the increasing adoption of sustainable practices. These sectors are pivotal in absorbing carbon dioxide through activities like reforestation, afforestation, and soil carbon enhancement in agriculture. Governments and international initiatives like REDD+ incentivize these practices, driving demand for validation and verification services. Corporations and investors also see these sectors as crucial for offsetting carbon footprints and integrating environmental goals into their strategies. Technological advancements in remote sensing and blockchain enhance the accuracy and transparency of carbon credit monitoring, further bolstering confidence in these sectors’ contributions to the market.

North America to emerge as the second-largest carbon credit validation, verification, certification market.

North America holds the second largest market share in the global carbon credit validation, verification, and certification market primarily due to robust regulatory frameworks promoting emissions reductions and carbon trading. The region’s commitment to climate action, supported by policies like the California Cap-and-Trade Program and initiatives in Canada, stimulates demand for verification and certification services. Additionally, a mature financial market and significant corporate interest in sustainability drive the adoption of carbon credits as a tool for achieving environmental goals. North American companies and organizations actively engage in offset projects across various sectors, contributing to the region’s substantial market presence in carbon credit validation and certification.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=229971770

List of Top Companies

Key players in the global carbon credit validation, verification and certification market include VERRA (US), Gold Standard (Switzerland), DNV GL (Norway), TÜV SÜD (Germany), SGS Société Générale de Surveillance SA. (Switzerland), Intertek Group plc (UK), Bureau Veritas (France), The ERM International Group Limited (UK), SCS Global Services (US), ACR (American Carbon Registry) (US), Climate Action Reserve (US), RINA S.p. A. (Italy), Aenor (Spain), SustainCERT (Luxembourg), Aster Global Environmental Solutions, Inc. (US), Carbon Check (India), Ancer Climate, LLC (US), Carbon trust (UK), First Environment Inc. (US), CRS (US), Cotecna (Switzerland), and Carbon credit Capital (US).

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: newsletter@marketsandmarkets.com

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/carbon-credit-validation-verification-certification-market-229971770.html