Advanced Ceramic Industry Overview

The global advanced ceramic market size was valued at USD 97.0 billion in 2019 and is expected to reach USD 130.2 billion by 2027, registering a CAGR of 3.7% during the forecast period. Rising demand from the end-use industries including renewable energy and medical are expected to propel market growth over the forecast period. Rising product demand from the clean technology industry will also support market growth.

For instance, products, such as solid oxide fuel cells are entirely made of advanced ceramics. Their benefits are anticipated to further increase their usage in the industry, by replacing single critical components like insulation materials. The market in the U.S. is majorly driven by the electronics industry where advanced ceramics are used in various applications such as substrates, circuit carriers, core materials, and other components. The electronics industry in the country, however, witnessed a decline in both production and consumption owing to the coronavirus outbreak, which affected the product demand.

Gather more insights about the market drivers, restrains and growth of the Global Advanced Ceramic Market

Advanced ceramics are widely used in several end-use industries such as electrical & electronics, automotive, machinery, renewable energy, medical, and others. The COVID-19 pandemic has disrupted the manufacturing & trade operations across the globe for all major industries, which is anticipated to hinder the market growth. According to the World Trade Organization, world trade is expected to decline by 13 to 32% in 2020 owing to the pandemic.

Although the pandemic hampered the product demand in the majority of the industries, it propelled its demand in the medical industry. Advanced ceramics emerged as an ideal material to play the role of the carrier that holds & transports blood probes in diagnostic equipment due to its biocompatibility. As pharmaceutical and med-tech companies are racing to expand their testing capacities, the demand for diagnostic equipment and thus, advanced ceramic carriers, is expected to increase during the pandemic.

Advanced Ceramic Market Segmentation

Based on the Material Insights, the market is segmented into Alumina, Titanate, Zirconate, Ferrite, Aluminum Nitride, Silicon Carbide, Silicon Nitride.

- Alumina dominated the market and accounted for the largest share of more than 34.0% in 2019. The segment is expected to maintain its dominance over the forecast period.

- Zirconate is one of the vital materials as it offers dielectric and ferroelectric properties, which drive its demand in the electronics industry.

- Ferrites have gained prominence owing to their magnetic properties, low cost, and easy availability. The segment is expected to register a growth rate of 3.5% over the forecast period.

Based on the Product Insights, the market is segmented into Monolithic, Ceramic Coatings, Ceramic Matrix Composites.

- Monolithic held the highest share of over 78.0% in 2019 and this trend is anticipated to continue over the forecast period.

- The ceramic matrix composites segment is expected to register the fastest CAGR during the forecast period. Properties of ceramic matrix composites, such as high-temperature resistance and toughness, are propelling their demand across a wide range of applications.

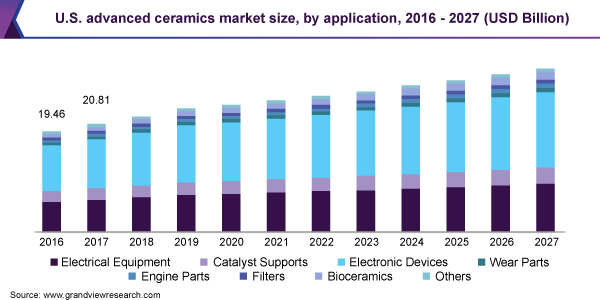

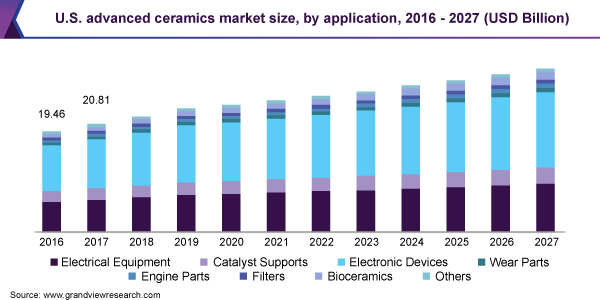

Based on the Application Insights, the market is segmented into Electrical Equipment, Catalyst Support, Electronic Devices, Wear Parts, Engine Parts, Filters, Bioceramics, and Others.

- Electronic devices emerged as the largest application segment, accounting for a share of more than 47% in 2019. Increasing technological advancements in the electronics and automotive industry are propelling the demand for sensors, which is a positive sign for the market growth.

- Electrical equipment is the second-largest segment. Advanced ceramics are used from insulators & resistors to semiconductors & sensors owing to their electrical properties.

- Bioceramics is expected to witness the fastest CAGR during the forecast period. These are specially designed for applications in the medical & dental industry.

- Catalyst support was the third-largest application segment in 2019. Advanced ceramics are used in this application segment as they offer corrosion resistance in aggressive chemical environments, help reduce particulate contamination, and exhibit high purity characteristics.

Based on the End-Use Insights, the market is segmented into Electrical & Electronics, Automotive, Machinery, Environmental, Medical, and Others.

- Electrical & electronics was the largest segment in 2019 and accounted for a share of more than 56%. The product is prominently used in the industry in various applications, such as power electronics, electronic sensors, and wafer production.

- Automotive accounted for a significant market share in 2019 and will expand further at a steady CAGR from 2020 to 2027, due to extensive product usage in electric water pumps that are used for controlling the temperature of engine and battery components for ensuring longevity and efficiency.

- The environmental segment is expected to register the second-fastest CAGR during the forecast period.

Based on the Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

- Asia Pacific dominated the global market and accounted for a share of more than 40.0% in 2019. The growth in the region is driven by increasing investments in the manufacturing sector of the developing economies, such as China, Japan, India, and Southeast Asian countries.

- North America accounts for a significant share in the market. Increasing emphasis on developing the manufacturing sector in the region coupled with the benefits of inculcating advanced ceramics in industries, such as aerospace and automotive, is anticipated to augment market growth.

Market Share Insights

- September 2021: Boston Micro Fabrication launches the new Projection Micro Stereolithography 3D printing system called microArch S230. The system builds ‘ultra-high-resolution’ of around 2μm at high speeds and accuracies. It has been introduce coupled with three more materials with applications in the medical ad electronic industry.

- November 2021: SINTX Technologies Inc., the real machinery manufacturer (OEM) of advanced ceramics, has launched its latest subsidiary called SINTX Armor.

Key Companies Profile:

The market is highly competitive. Most of the manufacturers are integrated across the different stages of the value chain. The pandemic caused several industries to shut down their manufacturing operations, which had a severe impact on the sales and profits of the market players.

Some prominent players in the global advanced ceramic market include

- 3M

- CeramTec GmbH

- Elan Technology

- Oerlikon Surface Solutions AG

- Ortech Inc.

- Morgan Advanced Materials PLC

- CoorsTek, Inc.

- Kyocera Industrial Ceramics Corp.

- Murata Manufacturing Co. Ltd.

- Saint-Gobain

Order a free sample PDF of the Advanced Ceramic Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/advanced-ceramics-market