The global Digital Lending Platform Marketis projected to account for USD 15.3 billion by the end of forecasted year 2026, according to new report by Million Insights, registering CAGR of 20.7% over the forecast period, from 2019 to 2026. Digitalization is the most common strategy adopted by financial institutions to enhance their customer services and to expand their core processing competencies. In financial institutions, digitalization in financing services helps them in the disbursement process, as well as in taking better decisions regarding loan management. The growing emphasis of financial institutions on digitalization to increase business productivity for better outcomes is projected to witness a positive impact on market growth.

Favourable government initiatives to promote the digital lending platform among businesses is anticipated to fuel the market growth during the forecast period. For example, in 2018, the Government of India introduced this platform for small, medium, and micros businesses in India. Digital lending platform allows these businesses to apply up to 10 million loan within 59 minutes. In addition, regulators by various economies including Hong Kong, U.K. Singapore, Australia, and U.S. have formed sandboxes to support innovation in financial services. Such initiatives adopted by regulators across several nations are expected to boost the growth of digital lending platform market over the forecast period.

To download the sample PDF of Global Digital Lending Platform Market Report “Please” click here: https://www.millioninsights.com/industry-reports/global-digital-lending-platform-market/request-sample

Advent of new technologies such as Artificial Intelligence (AI), block chain, robotic process automation, and Machine Learning (ML) is helping the financial institutions to make loan processing transparent without paperwork and helps to secure customer’s personal information. The technological advancement in digital lending platform has reshaped the businesses in the financial sector along with streamlining their operations. Further, it has improved the quality of services among end-use industries such as insurance companies, credit unions, and banks. For example, AI-based digital lending platform has capabilities to minimalize loan processing time and operating cost, thereby, expected to drive the market growth in the next seven years.

To browse report summary & detailed TOC, “please” click the link below:

https://www.millioninsights.com/industry-reports/global-digital-lending-platform-market

Further key findings from the report suggest:

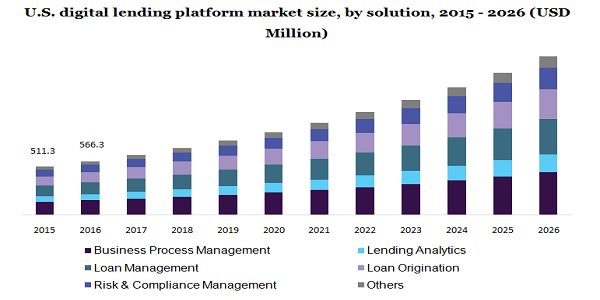

• Among solutions, the lending analytics segment is projected to grow at the highest CAGR of over 21.0% over the forecast period. This growth is attributed to growing adoption of several technologies such as artificial intelligence, machine learning, and IoT.

• The risk management segment is anticipated to exhibit with fastest CAGR of more than 23.0% during the forecast period. This is due to rising demand to proactively respond to several cyber-attacks and growing need to bring back all financial activities to normal state.

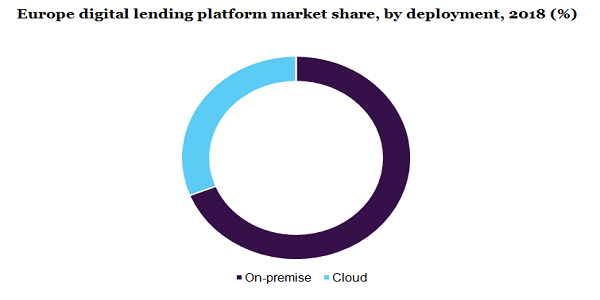

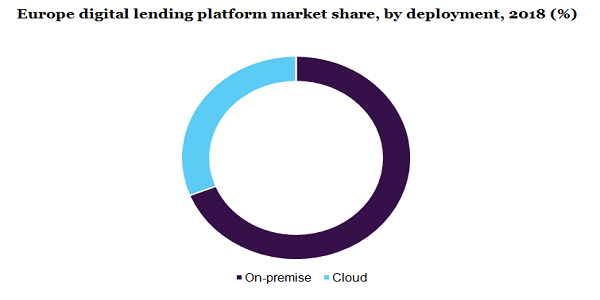

• The cloud segment is projected to grow with higher CAGR from 2019 to 2026, as it reduces the up-front costs among new entrants in this industry.

• Peer-to-peer category is projected to emerge as the highest growth segment over the next few years due to growing number of digital savvy consumers coupled with emergence of paperless financial services for retail propositions.

• In 2018, North America dominated the global digital lending platform market owing to the presence of a large number of tech giants coupled with robust infrastructure for this industry.

• FIS; Sigma Infosolutions; Newgen Software; Pegasystems Inc.; Roostify; Nucleus Software; Ellie Mae, Inc.; Wizni, and Tavan are key players operating in the market.

Million Insights has segmented the global digital lending platform market on the basis of solution, service, deployment, end use, and region:

Digital Lending Platform Solution Outlook (Revenue, USD Billion, 2015 – 2026)

• Business Process Management

• Lending Analytics

• Loan Management

• Loan Origination

• Risk & Compliance Management

• Others

Digital Lending Platform Service Outlook (Revenue, USD Billion, 2015 – 2026)

• Design & Implementation

• Training & Education

• Risk Assessment

• Consulting

• Support & Maintenance

Digital Lending Platform Deployment Outlook (Revenue, USD Billion, 2015 – 2026)

• On-premise

• Cloud

Digital Lending Platform End-use Outlook (Revenue, USD Billion, 2015 – 2026)

• Banks

• Insurance Companies

• Credit Unions

• Savings & Loan Associations

• Peer-to-Peer Lending

• Others

Digital Lending Platform Regional Outlook (Revenue, USD Billion, 2015 – 2026)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa

Read the Latest Press Releases available with Million Insights:

1. Data Protection & Recovery Solutions Market – The global data protection and recovery solutions market size is anticipated to reach USD 14.1 billion in the year 2025.

2. Ceramic Filter Market – The global ceramic filter market size is projected to touch USD 2.97 billion by 2025. The market is anticipated to exhibit a CAGR of 13.5% over the forecast duration.

About Million Insights

Million Insights, is a distributor of market research reports, published by premium publishers only. We have a comprehensive market place that will enable you to compare data points, before you make a purchase. Enabling informed buying is our motto and we strive hard to ensure that our clients get to browse through multiple samples, prior to an investment. Service flexibility & the fastest response time are two pillars, on which our business model is founded. Our market research report store, includes in-depth reports, from across various industry verticals, such as healthcare, technology, chemicals, food & beverages, consumer goods, material science & automotive.

Media Contact

Company Name: Million Insights

Contact Person: Ryan Manuel

Email: Send Email

Phone: 91-20-65300184

Address:Office No. 302, 3rd Floor, Manikchand Galleria, Model Colony, Shivaji Nagar

City: Pune

State: Maharashtra

Country: India

Website: https://www.millioninsights.com/industry-reports/global-digital-lending-platform-market