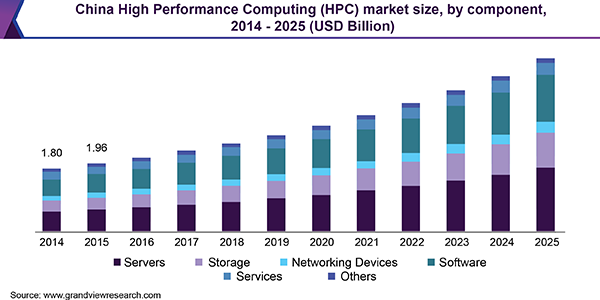

According to a report,“High Performance Computing (HPC) Market Size, Share & Trends Analysis Report By Component (Servers, Storage), By Deployment, By End Use (Gaming, Government & Defense), And Segment Forecasts, 2018 – 2025”, published by Grand View Research, Inc., the global high performance computing (HPC) market size is expected to reach USD 59.65 billion by 2025. It is anticipated to expand at a CAGR of 7.2% over the forecast period. High performance computing can be categorized into High Performance Technical Computing (HPTC) and High Performance Business Computing (HPBC). HPTC is widely used in fields like science and engineering. It is particularly used by government and defense agencies, educational and research institutions, and incumbents of manufacturing industry, among others. On the other hand, HPBC is suitable for applications, such as gaming and fraud detection. Logistics companies and providers of financial services, among others, also opt for HPBC. The rising popularity among manufacturing companies, government departments, and defense agencies is particularly driving growth of the HPC market.

Key Takeaways from the report:

-

The on-premise segment held the largest market share in 2017. However, the cloud segment is expected to expand at the highest CAGR of over 8.0% over the forecast period owing to the benefits, such as cost-effectiveness, scalability, ease of deployment, and stronger security associated with cloud deployment

-

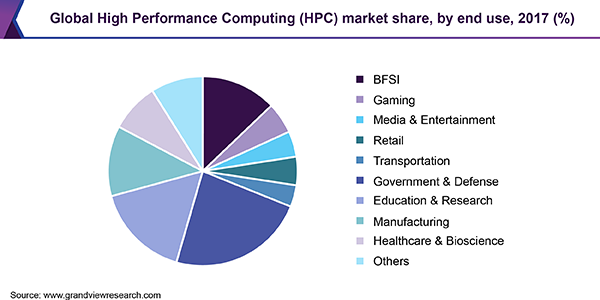

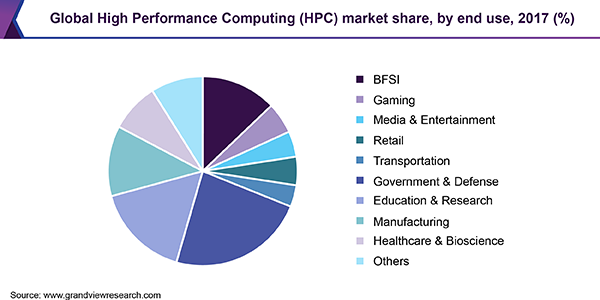

The government and defense segment held the largest market share in 2017 and is also expected register the highest CAGR over the forecast period. This growth can be attributed to rising adoption of HPC in surveillance, aircraft simulation, and encryption and decryption of confidential information

-

North America is anticipated to witness a significant growth over the forecast period. New supercomputing facilities are coming up in the region in line with the advances in technology, which bodes well for the regional market growth. U.S. is home to the top-5 supercomputers and the U.S. HPC market held the largest market share of over 60% in 2017 and is expected to lead the regional growth over the forecast period

-

The high performance computing market is highly consolidated and competitive. Atos SE; Advanced Micro Devices, Inc. (AMD); Cray Research, Inc.; Dell Technologies, Inc.; and Cisco Systems, Inc. are some of the leading market players

-

Key industry players are striking partnerships and collaborating with each other as part of their efforts to strengthen their market position. For instance, in September 2017, Cray Research Inc. entered into a strategic partnership with Seagate. The partnership envisages the former procuring drives, containers, controllers, and other components related to the high performance computing technology from the latter.

Browse More Reports in Communications Infrastructure Industry:

- Software Consulting Market: The growing demand for digitalization in business processes and low start-up costs associated with software consulting services are expected to drive the growth of the market. The growing adoption of enterprise software solutions to increase productivity and efficiency of an organization is driving the demand for software consulting services for efficient installation and use of these solutions.

- Warehouse Management System (WMS) Market: Growing transition towards cloud-based management systems in the warehouse industry is anticipated to boost the demand for WMS based on the Software-as-a-Service (SaaS) model. Advancements in cloud-based technologies are estimated to fuel the adoption of WMS software irrespective of the size and complexity of the organization where these solutions are used.

High performance computing envisages a cluster of computers that can run long algorithms and solve complex problems and equations at speeds and accuracies higher than those offered by the conventional computing. Previously, HPC was used only by the navigation and aerospace industries. However, diversification of the IT industry, growing adoption of cloud computing, continuous developments in artificial intelligence, and the rising need for business analytics are prompting various end-use industries to adopt HPC.

Data centers particularly require an architecture capable of processing large volumes of data. HPC components can ensure adequate computing power for such data centers. Various other organizations also adopt HPC to process their data at higher speeds and accuracies and to simplify their complex business procedures. Research and academic institutions have also started adopting high performance computing systems to ensure the computational efficiency required during the initial stages of research.

The high computational capabilities offered by HPC systems have paved the way to execute high-end research projects previously deemed impossible. As such, HPC systems can be helpful in several fields, including computational biology, genetics, medicine, structural analysis, geophysics statistics, electromagnetism, nuclear physics, astrophysics, and mathematical modeling, among others. Similarly, the high efficiency offered by high performance computing can help researchers in undertaking research activities in various fields, such as deep neural networks, human genome mapping and modeling, and artificial intelligence, among others.

Vendors of high performance computing are increasingly focusing on delivering enhanced solutions that can cater to various requirements. These solutions may include basic configurations and management tools that are easy to deploy and are capable of adapting to the changing workloads. Although the application portfolio of high performance computing is growing continuously; the looming lack of awareness, budget constraints at small- and medium-sized enterprises, and concerns over data security are some of the factors hindering growth of the high performance computing market.

Grand View Research has segmented the global high performance computing market based on component, deployment, end use, and region:

High Performance Computing (HPC) Component Outlook (Revenue, USD Million, 2014 – 2025)

-

Servers

-

Storage

-

Networking Devices

-

Software

-

Services

-

Cloud

-

Others

High Performance Computing (HPC) Deployment Outlook (Revenue, USD Million, 2014 – 2025)

-

On-premise

-

Cloud

High Performance Computing (HPC) End Use Outlook (Revenue, USD Million, 2014 – 2025)

-

Banking, Financial Services, and Insurance (BFSI)

-

Gaming

-

Media & Entertainment

-

Retail

-

Transportation

-

Government & Defense

-

Education & Research

-

Manufacturing

-

Healthcare & Bioscience

-

Others

High Performance Computing (HPC) Regional Outlook (Revenue, USD Million, 2014 – 2025)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research provides syndicated as well as customized research reports and consulting services on 46 industries across 25 major countries worldwide. This U.S.-based market research and consulting company is registered in California and headquartered in San Francisco. Comprising over 425 analysts and consultants, the company adds 1200+ market research reports to its extensive database each year. Supported by an interactive market intelligence platform, the team at Grand View Research guides Fortune 500 companies and prominent academic institutes in comprehending the global and regional business environment and carefully identifying future opportunities.

For more information: www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1-415-349-0058, Toll Free: 1-888-202-9519

Address:201, Spear Street, 1100

City: San Francisco

State: California

Country: Switzerland

Website: www.grandviewresearch.com/industry-analysis/high-performance-computing-market