The global ride hailing services market size is expected to reach USD 82.37 billion by 2025, according to a new report by Grand View Research, Inc. It is projected to register a CAGR of 12.8% during the forecast period. Rising need to combat the rushing traffic coupled with piling road taxes is expected to expand the scope of ride-hailing services. These rides are easily traceable and the contacts of both the passenger and driver are easily accessible. Low cost of car ownership and growing employment opportunities is expected to open new avenues over the next few years. As per official statistics provided by Uber at the end of 2019, their driver number stood at 5 million, signifying the increasing number of people turning to ride hailing services as a means of employment.

The high rate of smartphone penetration has led to positive developments in the application ecosystem, which ride hailing services have been keen to exploit. Competitive rates and ride safety have been some of the features that make consumers choose ride hailing services over normal rides. As per data by Pew Research, 99% of citizens in the United States are familiar with the ride-hailing concept, while 36% have availed the service, with Uber and Lyft being at the forefront of customer choice. Automotive manufacturers have been keen to expand their market through the introduction of such services in promising economies such as China and India. For example, in December 2020, Alibaba and Contemporary Amperex Technology (CATL; Tesla’s battery supplier) invested 300 million yuan ($46 million) into SAIC Motor’s ride hailing service that operates in China. The self-driving vehicle environment is also presenting numerous growth avenues to the industry. Additionally, ride-hailing services are expanding to the food delivery setup also, the prime example being Uber Eats.; Lyft is also entering this space by partnering with Grubhub for free food delivery for Lyft Pink monthly subscribers through the app.

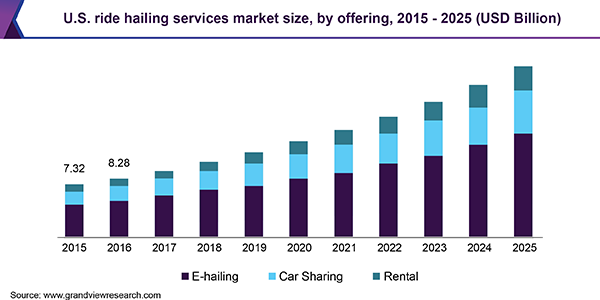

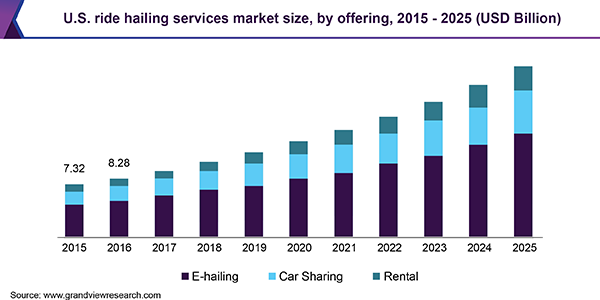

The current outbreak of the coronavirus pandemic had a massive impact on the overall ride-hailing service industry, as the government-imposed lockdowns across the globe for a major part of 2020 led to heavy loss in revenue for the market players. As a result, companies have tried to modify their offerings in order to follow government regulations, while ensuring flow of revenue. The major offerings by the industry players include e-hailing, car sharing, and rental services, with countries such as the United States, India, China, and Western European countries being the key regions for revenue growth. Some of the notable market competitors are Uber, Lyft, Via, Juno, Xoox, Wheely, ViaVan, My Taxi, Gett, Addison Lee, Ola, Kabbee, BlaBlaCar, Lyft, Grab, Didi Chuxing, and Yandex.taxi

Further key findings from the report suggest:

1 The use of ride-hailing services has proved to be highly beneficial for officegoers and daily commuters, on account of savings on petrol and diesel, coupled with no hassles regarding parking space, with reports suggesting that such expenses can be cut by 50% through use of ride-hailing services

2 A study by the University of Pennsylvania noted that the availability of ride-hailing services for most parts of the day have helped in reducing the number of drunk-driving incidents, thus making them a safe option

3 The availability of online payment options as well as ride-tracking features have helped to create a positive image for these services among consumers, thus driving market growth

4 With regards to offering, the e-hailing segment accounted for more than 50% of the market share in terms of revenue in 2018, with advantages such as user-friendliness and minimal chance to cheat the customer aiding in the demand

5 The car rental offering segment is expected to register the fastest CAGR of 13.8% through 2025, on account of desirable perks such as control over route, time, and comfort

6 North America held a market share exceeding 35% in 2018 and is anticipated to register significant growth through 2025, while Asia Pacific is expected to witness the fastest CAGR of 13.9% in the industry during the forecast period

7 With COVID-19 having significantly impacted the revenues of the ride-hailing service industry in 2020, companies are striving to return to normalcy by constant sanitation of their vehicles, as well as more transparency with riders, thus helping in stabilizing the market

8 Over the past 2-3 years, the industry has seen multiple developments, especially in economies such as China and India. For example, in January 2019, TukTuk Ride launched a new ride hailing service app for 10 major cities in India, with consumers needing to pay INR 14/kilometer for cabs & INR 8/kilometer for bike taxis

9 In January 2019, Grab Holdings Inc. announced plans for commencing three new ride hailing services under the names, GrabShuttle, GrabCall, and GrabCall in Myanmar. GrabShuttle will be targeted at office workers and university students and GrabCall will allow booking cabs through call center agents

10 The autonomous infrastructure is expected to provide a significant thrust to the industry growth. For example, Lyft announced in December 2020 that it would be deploying fully driverless vehicles on its network starting 2023 across multiple US cities, in collaboration with its driverless technology partner, Motional

“Would you Like/Try a Sample Report” Click the link below: https://www.grandviewresearch.com/industry-analysis/ride-hailing-services-market/request/rs1

Grand View Research has segmented the global ride hailing services market on the basis of offering and region:

Ride Hailing Services Offering Outlook (Revenue, USD Million, 2015 – 2025)

-

E-hailing

-

Car Sharing

-

Rental

Ride Hailing Services Regional Outlook (Revenue, USD Million, 2014 -2025)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

List of Key Players of Ride Hailing Services Market

• Uber

• Lyft

• Via

• Juno

• Xoox

• Wheely

• ViaVan

• My Taxi

• Gett

• Addison Lee

• Ola

• Kabbee

• BlaBlaCar

• Lyft, Grab

• Didi Chuxing

• Yandex.taxi

Have Any Query? Ask Our Experts for More Details on Report: https://www.grandviewresearch.com/inquiry/6173/ibb

Browse Related Report @

Pressure Washer Market – https://www.grandviewresearch.com/industry-analysis/pressure-washer-market

Explore the BI enabled intuitive market research database, Navigate with Grand View Compass, by Grand View Research, Inc.

About Grand View Research

Grand View Research is a market research and consulting company registered in the State of California having its headquarters in San Francisco. The company offers syndicated research reports, customized research reports, and consulting services. With Grand View Research, you get an opportunity to understand market trends, insights, and business statistics from a strategic standpoint. With a deep-seated understanding of many business environments, Grand View Research offers business and market intelligence studies and accomplishes more than 300 multi-country market studies.

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/ride-hailing-services-market