Saudi Arabia News

- The Seaport Authority have started an EDI platform for recording all the Import, Export and transshipment Transactions by all logistics Companies in KSA. This is expected to Streamline the process of sea freight by Automation.

- The Government is spending SAR 135 Bn for transport Infrastructure in Next 11 years including Rail freight for cheaper mode of transportation for Bulky Goods.

- Due to Covid, Online retailing and E commerce is getting extremely Popular in KSA and is expected to flourish in next 5-10 years.

Infrastructural Advancement: Government is introduced trade zones such as Jizan Economic city with additional Duty Exemptions, Subsidies and Benefits, New infrastructure such as Jazan Airport, Neom Airport, SPARK zone, expansion in the Red Sea Gateway Terminal (RSGT), Introduction of commercial routes linking Seaports and airports to transport and re-export goods are few of initiatives by government to expand KSA logistics Operations making it a global transshipment hub aligned to National Logistics Policy.

Increasing scope of Retail and E commerce logistics: KSA Government opened the retail and wholesale sectors to 100% foreign ownership and has launched a large privatization programme. This is primarily done to reduce the Oil Revenues dependency and expansion to other sectors aligned with Vision 2030. Due to COVID, People prefer online purchases more than Physical visit to the stores making E- Commerce and online retailing quite popular in KSA. Big retailers for instance, Carrefour and Abu Dawood reported surge in online sales of up to 200-300% in 2020 and further expect an escalating growth trajectory in the long-term.

Advancement in Technology: Technologies such as GPS tracking, RFID Tags and control towers are still not very popular in Saudi Arabia and are used by companies with additional costs as per the Client requirements. Other upcoming technologies include real time fuel management system, Platooning, ASRS, warehousing management system, cargo management systems and communication and information systems such as EDI which can be used to reduce paperwork and minimize time taken for compliance procedures.

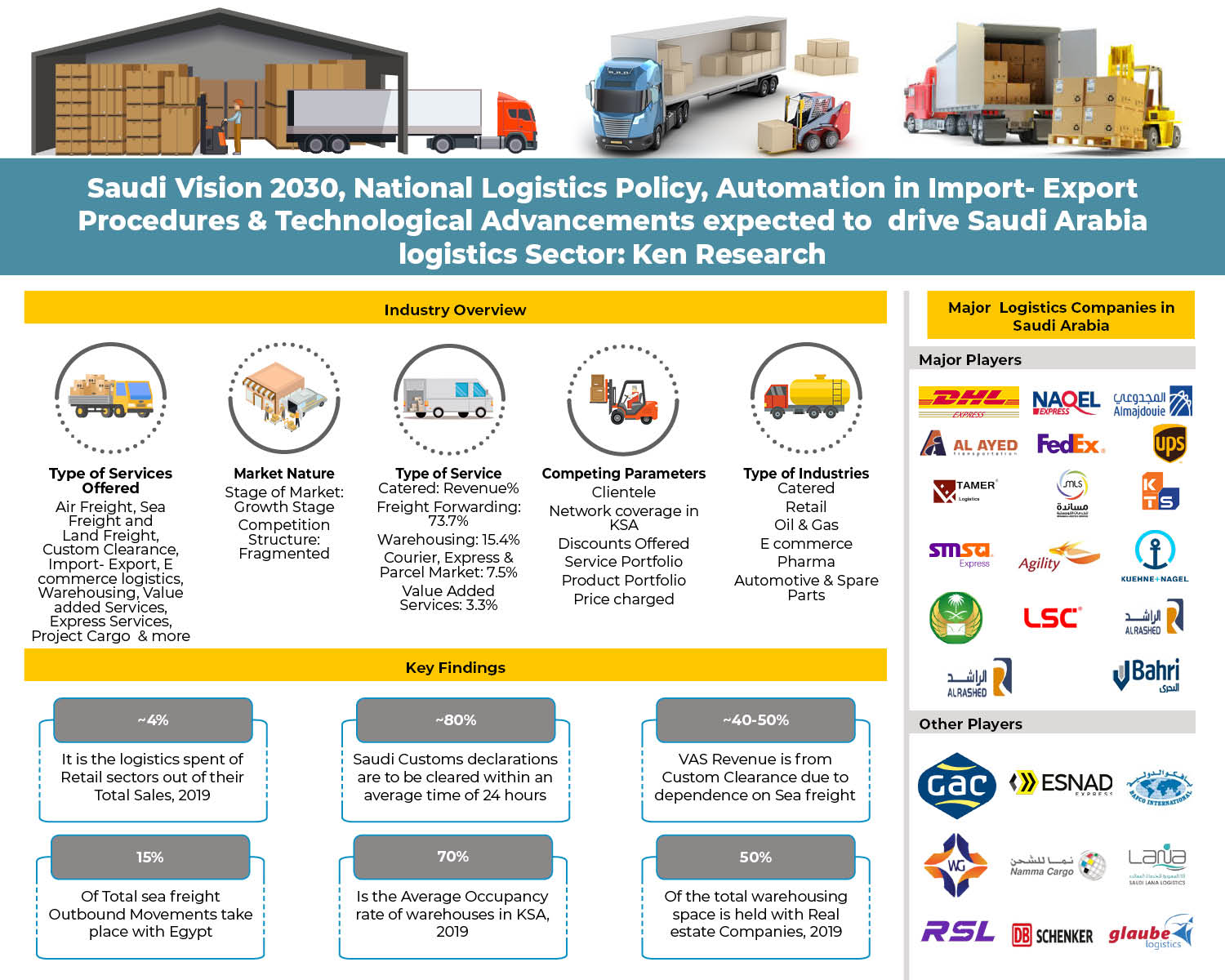

Analysts at Ken Research in their latest publication “Competition Benchmarking of Top Logistics Players in KSA in Transportation, Warehousing, 3PL, International Express, Domestic Express, Automotive, Pharma, Oil and Gas and Retail Logistics” believe that the Logistics Market in Saudi Arabia is expected to grow due to Automation of Import Export Procedures on Seaports reducing congestion ad Clearance time, Introduction of new Airports and Economic Cities for logistics Operations in Saudi Arabia.

Key Target Audience:-

- Freight Forwarding Companies

- E Commerce Logistics Companies

- 3PL Companies

- Consultancy Companies

- Logistics/Warehousing Companies

- Real Estate Companies/ Industrial Developers

Time Period Captured in the Report:-

- Historical Period – 2015-2019

- Forecast Period – 2019-2025F

Companies Mentioned:-

- Bahri logistics

- Saudi Post

- NAQEL Express

- Kuehne Nagel

- Almajdouie logistics

- DHL Express

- Fedex Express

- Al Ayed Transport

- SMSA Express

- Tamer logistics

- BAFCO shipping and Logistics

- DB Schenker

- Agility

- JAS Worldwide

- Kanoo Terminal Services

- LSC warehousing and logistics

- Hala Supply Chain

- Namma Cargo

- Wared logistics

- Al Rashed transport

- UPS

- Kerry logistics

- Mubarrad transport

- Hellman logistics

- OCSCL Shipping and Logistics

- Al karsf

- SMT logistics

- Saudi Lana logistics

- Fourwinds logistics

- Takhzeen

- NTF cargo

- Alpha Cargo

- GAC

- Platinum Shipping and Logistics

Key Topics Covered in the Report:-

- Saudi Arabia logistics Market size by Revenues

- Saudi Arabia logistics Market Segmentation By type of Service (Freight Forwarding, warehousing, Courier, Express and parcel Market and Value added services) By Revenues

- Market Segmentation by Modes of Freight (Including Domestic and International Cargo travelled for each Mode of freight, FTK travelled, Price per ton per kilometer)

- Market size of Warehousing (Revenue, Total warehousing Space Average Occupancy, Revenues, Average Price per sqm per Month)

- Warehousing Space by Type of Entity (Real estate companies, Logistics Companies, Captive Companies)

- Warehousing Space by Type of Warehouses ( Industrial/ Retail, Agricultural, Cold Storages, ICD/CFS)

- Courier, Express and Parcel Market ( Domestic/ International Revenues, Average Price per Domestic and International Shipments, Total Domestic/ International Shipments)

- E commerce logistics Market size in Saudi Arabia

- Top Companies dealing in each Service and Sub Service (Land freight, Sea freight, Air freight By Volume, warehousing companies by warehousing Space, Express companies by International/ Domestic Revenues)

- Top Companies by revenues dealing in each Vertical ( E commerce, Retail , Oil and Gas and Pharma logistics)

- Market Share of Logistics Companies in KSA By Service Mix and By Each Industry Verticals

- Competition Analysis of Major Logistics Players in KSA by Revenues

- Competition Analysis of Major Logistics Players in KSA ( including Volume, Average warehousing Space, Fleets, Average Occupancy rate, Network, Client Retention, Industries catered, Services offered, Technology, Certifications, Strength)

- Saudi Arabia Logistics Market

- Market Share Saudi Logistics Market

- Market Share KSA Road Freight Market

- Market Share KSA Air Freight Market

- Market Share KSA Sea Freight Market

- Market Share KSA Warehousing Market

- Market Share KSA Domestic Express Market

- Market Share KSA International Express Market

- Market Share KSA Oil and Gas Logistics Market

- Market Share KSA Automotive Logistics Market

- Market Share KSA Pharma Logistics Market

- Market Share for KSA Retail Logistics Market

- Saudi Arabia Freight Transportation Market

- Saudi Arabia Road Freight Market

- Saudi Arabia Rail Freight Market

- Saudi Arabia Air Freight Market

- Saudi Arabia Sea Freight Market

- Saudi Arabia Trucking Industry

- Ksa Ecommerce Logistics Market Size

- Constructing Warehousing Facilities in Saudi Arabia

- Warehouse Registration Saudi Arabia

- Total Warehousing Space Saudi Arabia

- Warehousing Price Saudi Arabia

- Warehousing Occupancy Rate Saudi Arabia

- Logistics and Distribution Centers Saudi Arabia

- Industrial/ retail warehouses Saudi Arabia

- Agricultural warehouses Saudi Arabia

- Cold Storages Saudi Arabia

- International Parcels Saudi Arabia

- Domestic Shipments Saudi Arabia

- Average logistics Cost Saudi Arabia

- E commerce logistics Companies Saudi Arabia

- Retail logistics Companies Saudi Arabia

- Pharma logistics Companies Saudi Arabia

- Oil and Gas logistics Companies Saudi Arabia

- VAT Impact on KSA Logistics & Transportation

- Robotic Automation KSA Warehousing

- Big Data Analytics KSA Warehousing

- Drone Technology KSA Warehousing

- COVID Impact Saudi Warehousing Market

- COVID Impact Saudi Freight Forwarding Market

For more information on the research report, refer to below link:-

Logistics industry Saudi Arabia

Related Reports:-

The cold chain market in UAE is at growth stage. It has consolidated its position as a global transshipment hub due to its central location in the GCC region. The high dependence of the country on imports to meet its food requirements has necessitated the development of cold chain facilities. In the review period 2014-2019, the UAE cold chain market has increased at a positive CAGR of 6.6% largely due to rising food and pharmaceutical imports, growth of the dairy industry, increasing number of modern grocery retail stores, government initiatives to reduce dependence on oil-exports and others.

Levels of domestic manufacturing in the country have remained very low since 2009. On the account of this industries have majorly required freight forwarding services from logistics service providers during this period. This has left very limited scope for end-to-end logistics services in country. Moreover, small size of the domestic manufacturing has forced the logistics companies to serve the international markets in the recent years which have made cost effectiveness very important.

The market showcased a volatile growth trajectory. Dry logistics revenue declined at a CAGR of single digit CAGR during 2015-2019 due to oil price shock further leading to an economic slowdown during 2016-2017 period. Saudi Arabia is located at the crossroads of significant international trade route that connects Asia, Europe and Africa. This strategic location provides the Kingdom with a unique advantage over other nations thus, enabling it to become a leading regional logistics hub. In April of 2016, Saudi Arabia announced its Vision 2030 which includes transforming the Kingdom into a preferred logistics hub. It is making continuous efforts to make imports and exports processes more streamlined. Additionally, government is restructuring the regulations and structures logistics sector government and opening the way for market liberalization and private sector participation. Expansion of industrial cities continues to offer opportunities for foreign investors towards developing the non-oil manufacturing base, warehousing & logistics segments. For instance, Pfizer opened a manufacturing facility in the King Abdullah Economic City in the year 2017. Non-oil manufacturing growth is facilitated by launch of National Industrial Development and Logistics Program (NIDLP) in Jan 2019 by KSA government. Various companies are investing in Special bulk trucks and heavy lift movements to diversify their Revenue streams and Operations. For instance, Bahri launched new dry-bulk carrier ‘Sara’ & increased their total fleet of dry-bulk carriers to 6 ships in KSA.

Follow Our Social Media Pages:-

Facebook: https://www.facebook.com/kenresearch

Twitter: https://twitter.com/KenResearch

LinkedIn: https://www.linkedin.com/company/ken-research/

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Media Contact

Company Name: Ken Research Private Limited

Contact Person: Ankur Gupta

Email: Send Email

Phone: 919015378249

Address:Unit 14, Tower B-3 Spaze i Tech park Sohna Road

City: Gurugram

State: Haryana

Country: India

Website: www.kenresearch.com