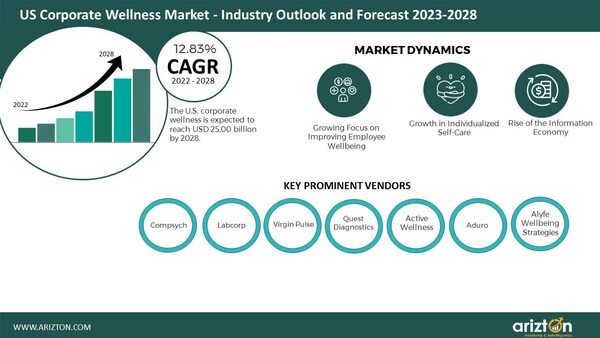

According to Arizton’s latest research report, the US corporate wellness market is growing at a CAGR of 12.83% during 2022-2028.

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3843

The US business landscape is at an intersection where companies are doing well. Still, employees go through epidemic levels of stress and depression due to more responsibilities, a dwindling workforce, a toxic office environment, and others. Unhealthy lifestyles that constitute inactivity, smoking, and bad nutrition spiral healthcare costs out of control. The long-term impact of these issues on the quality of life and performance of employees is significant. This and the colossal healthcare costs in the US warrant the need for corporate wellness programs to sustain a thriving standard of high-quality life. The US’s leading drivers for health and wellness programs are the need for healthy eating and exercise, a high prevalence of obesity, and the reduction of insurance and healthcare costs. Corporate profits that recorded an uptick after a long period of sluggish growth also fuel the adoption of wellness programs. This puts employees in a better place in terms of being able to allocate budgets for corporate wellness programs. Therefore, the US corporate wellness market is expected to grow in the upcoming years.

Almost 50% of employers in the US offer financial wellness programs in sync with their retirement plans. Larger employers already offer programs in this space, while smaller ones work on implementing them. Companies also focus on certain benefits over others, such as debt counseling services and emergency savings accounts during the pandemic. Tuition reimbursement and discount programs are not so popular. Caregiving loans, short-term loans, emergency funds, debt management services, and payroll advances are increasingly used by employees. There is also increased emphasis on short-term financial wellness, particularly concerning healthcare. Employers increasingly look to address retirement preparedness and healthcare costs with financial wellness programs.

Key Insights

- Employers in the US are more concerned about protecting their employees from financial, physical, and mental challenges to help them get through the immediate impact of COVID-19. This, in turn, brought a significant wave to the demand for corporate wellness in the US.

- 2022 the US corporate wellness market was valued at $12.12 billion. It is expected to grow at a CAGR of 12.83% during the forecast period.

- Based on the program, HRA dominated the market in revenue with a market share of 16.29% in 2022.

- In 2022, the large private sector businesses held most of the market share by end-user segment at 43.97%. In contrast, medium private sector businesses are expected to grow at the fastest growth rate at a CAGR of 12.92% during the forecast period.

- The corporate wellness market is divided into onsite and offsite segments based on delivery mode. In 2022, the onsite segment dominated the market with a revenue share of 77.49% during the forecast period.

- Wellness programs can change corporate culture, and employers thus take measures to improve their employees’ work-life balance and lifestyle by shaping new behavioral norms. More companies introduce corporate wellness programs, which will, in turn, put pressure on their competitors to follow suit as healthcare benefits are among the most valued benefits among employees in the US.

Vendor Insights

Over the past couple of years, however, the market witnessed the entry of many external players, such as in-house services by large businesses and other entities, in the health and fitness space that offer membership discounts to drive up their share in the market. M&As are expected within the industry as players look to expand and become more comprehensive in their offerings. A trend witnessed among vendors in a landscape where consolidation occurs is the focus on merging two platforms. Resources are spent on merging rather than innovation as large players join hands.

U.S. Corporate Wellness Market Dynamics

Drivers:

Improvements in Employee Wellbeing Due to COVID-19

Increased Individualized Selfcare

Rise of the Information Economy

Broad Shift in Wellness Perspectives

Reduction of Load on US Healthcare Systems by Corporate Wellness Programs

Opportunities:

Wellness Driven by Data Analytics

Extension of Wellness Programs to Families

Incorporation of Social Connectedness

Increased Penetration of Telehealth

Mental & Physical Health Awareness on Social Media

Challenges:

Remote Work & Increased Surveillance by Employers

Constant Struggle for Employee Engagement & Participation

Perceived Expensiveness of Wellness Programs

Buy the Report Now: https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% of customization

Market Segmentation

- Program: HRA, Nutrition & Weight Management, Smoking Cessation, Fitness Services, Alcohol & Drug Rehab, Stress Management, Health Education Services, Financial Wellness, and Others

- Revenue Model: Recurring Revenue Model and Seasonal Revenue Model

- Delivery Model: Onsite and Offsite

- Incentive Programs: Participatory Programs and Health-Contingent Programs

- Type: Services and Technology

- Industry: Media and Technology, Healthcare, Financial Services, Manufacturing, Retail, and Others

- End-user: Large Private Sector Businesses, Medium Private Sector Businesses, Public Sector Companies, Small Private Sector Businesses, and Non-Profit Organizations

- Region: The U.S. (South, West, Midwest, and Northeast)

Key Company Profiles

- Compsych

- Labcorp

- Virgin Pulse

- Quest Diagnostics

- Active Wellness

- Aduro

- Alyfe Wellbeing Strategies

- American Specialty Health

- Aquila

- AYCO

- Bank of America Merill Lynch

- BaySport

- Beacon Health Options

- Best Money Moves

- Brightdime

- Brightside

- BSDI

- Castlight Health

- Ceridian

- Corporate Fitness Works

- DHS Group

- Edukate

- Elite Wellness

- Enrich

- Even

- EXOS

- Financial Fitness Group

- Financial Knowledge

- FlexWage

- GoPlan 101

- HealthCheck360

- HealthFitness

- HealthTrax

- Holberg Financial

- Health Advocate

- Integrated Wellness Partners

- Karelia Health

- Kersh Health

- Kinema Fitness

- LearnLux

- LifeCents

- LifeDojo

- LifeStart

- Limeade

- LIVunLtd

- Marino Wellness

- Marathon Health

- Mercer

- Midtown Athletic Club

- Money Starts Here

- My Secure Advantage

- NIFS

- OptumHealth

- Orriant

- Payactiv

- Power Wellness

- Premise Health

- Privia Health

- Professional Fitness Management

- Prudential Financial

- Purchasing Power

- Ramsey Solutions

- Reach Fitness

- Sonic Boom Wellness

- Sprout

- StayWell

- Transamerica

- Vantage Circle

- Vitality Group

- Wellable

- Wellness Coaches USA

- Wellsource

- WellSteps

- Wisdom Works Group

- Woliba

- Workstride

- WTS International

- Origin

- BrightPlan

- Savology

- Sqwire

- FinFit

- Pro Financial Health

- FutureFuel.io

- Salary Finance

- SoFi

- Sum180

- The Financial Gym

- PDHI

- Novant Health

Key Questions Answered in the Report:

How big is the U.S. corporate wellness market?

What is the growth rate of the U.S. corporate wellness market?

What are the growing trends in the U.S. corporate wellness market?

Which region holds the most significant U.S. corporate wellness market share?

Who are the key players in the U.S. corporate wellness market?

Check Out the Detailed Table of Contents of the Report @ https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024?details=tableOfContents

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024