Video Streaming Industry Overview

The global video streaming market size was valued at USD 59.14 billion in 2021 and is expected to reach USD 330.51 billion by 2030, at a CAGR of 21.3% from 2022 to 2030.

Innovations such as blockchain technology and Artificial Intelligence (AI) are used to improve video quality. AI is playing an essential role in editing, cinematography, voice-overs, scriptwriting, and several other aspects of video production and upload. These innovations are anticipated to positively influence the growth of the market. Various video streaming solution providers are using AI to improve the content quality of videos. In the recent past, the popularity of such platforms over broadcast media such as YouTube and Netflix has increased considerably. In May 2016, Netflix implemented AI to create a superior personalized experience for its subscribed consumers.

Moreover, the rapid adoption of mobile phones owing to the growing popularity of social media platforms and other digital mediums for branding & marketing is anticipated to fuel the market growth.

Gather more insights about the market drivers, restrains and growth of the Global Video Streaming Market

The growing adoption of cloud-based solutions is boosting the market growth. This trend is majorly observed in North America and Europe. Ongoing innovations and technological advancements are expected to meet the growing users’ expectations for exceptional video quality, performance, and security. For instance, in April 2019, Akamai Technologies spotlighted its innovations in delivering digital experiences of high quality at the 2019 NAB Show (U.S.). The company showcased its advancement in live and on-demand media services such as cloud wrapper, direct connect, and cloud interconnects.

The rising adoption of digital media across various industries has resulted in the population’s inclination toward multiple streaming services. For instance, in November 2019, Apple Inc. entered the online video cascading industry by launching its TV+ service. In June 2019, Wowza Media Systems, LLC announced the launch of a complete range of professional services for video-related solution providers. Furthermore, in March 2019, Google, the subsidiary of Alphabet Inc., unveiled its cloud-based gaming console, Yeti, which features a game streaming service along with gaming hardware.

The increase in technological advancements and the number of service providers in the market pose a threat to the standalone streaming giants. For instance, in July 2019, AT&T Intellectual Property launched a new streaming service called AT&T TV to facilitate people watching television online. In April 2018, Amazon.com, Inc. partnered with Google to bring official YouTube applications to Amazon’s Fire TV. These complementary services for television and other entertainment content are anticipated to pose a threat to existing key players in the market.

In the education and academic sector, videos can be effectively used in webinars and courses to enhance teaching and learning processes. Visual recordings have a powerful impact on students’ ability to retain information. Therefore, universities, schools, and colleges are now creating multimedia content and delivering it in the form of video presentations. Factors such as easy access to educational video content, growing demand for mobile devices, and increasing availability of the internet are positively influencing the adoption of live video streaming services for educational purposes.

The COVID-19 pandemic placed more than one–fourth of the world’s population under lockdown. As millions of individuals remained locked into their homes, the online video streaming and entertainment services experienced a rise of around 10% in viewership during the lockdown. As a result, video streaming platforms such as Netflix, Amazon Prime Video, YouTube, and Disney+ registered a spike in the viewership worldwide. For instance, in March 2020, Netflix registered an increase of more than 50% in the number of new installations of its mobile application in Italy and more than 30% of that in Spain.

Video Streaming Market Segmentation

Based on the Streaming Type Insights, the market is segmented into Live Video Streaming and Non-Linear Video Streaming.

- The live streaming segment accounted for the largest revenue share in 2021, with around 61% market share.

- Non-linear streaming is expected to demonstrate significant growth over the coming years owing to the convenience and series linking. Several other factors that fuel the growth of the non-linear streaming segment in the industry include watch-time feasibility, no buffering, large capacity, and live pause.

Based on the Solution Insights, the market is segmented into Internet Protocol TV, Over-the-Top (OTT) and Pay-TV.

- The OTT segment accounted for the largest share of over 42% in 2021. OTT solutions deliver film and TV content through the internet without users’ subscriptions to traditional cable or pay-TV services.

- The pay-TV segment accounted for a notable revenue due to a significant rise in demand for pay-TV services in countries such as China, India, Mexico, and Brazil.

Based on the Platform Insights, the market is segmented into Gaming Consoles, Laptops & Desktops, Smartphones & Tablets and Smart TV.

- The smartphones and tablets segment accounted for the largest revenue share in 2021, with over 31% market share.

- Smart TV segment is expected to register significant growth over the forecast period as smart TV offers a comprehensive option of TV channels along with video streaming services such as Netflix.

Based on the Service Insights, the market is segmented into Consulting, Managed Services and Training & Support.

- The training & support segment accounted for the largest revenue share in 2021, with nearly 38% market share.

- The managed services segment is estimated to have a significant market share, representing around 31% of the total market in 2021.

Based on the Revenue Model Insights, the market is segmented into Advertising, Rental and Subscription.

- The subscription segment accounted for the largest revenue share in 2021, with more than 43% market share.

- Advertising is one of the common forms of monetizing streaming videos where the revenues are generated from advertisers. Since advertisers pay a massive amount for streaming their advertisements on on-demand streaming platforms owing to the marketing requirements, the advertising segment accounts for a significant share of the market.

Based on the Deployment Type Insights, the market is segmented into Cloud and On-Premises.

- The cloud segment accounted for the largest revenue share in 2021, with more than 58% of the market share. The cloud segment in Asia Pacific is expected to register the highest CAGR in the coming years.

Based on the User Insights, the market is segmented into Enterprise and Consumer.

- The consumer segment accounted for the largest revenue share in 2021, with nearly 51% market share. This is attributed to the rise in the viewership of video on demand and live streaming services from the media and entertainment sector.

- The enterprise segment is expected to grow at a CAGR of 21.8% over the forecast period.

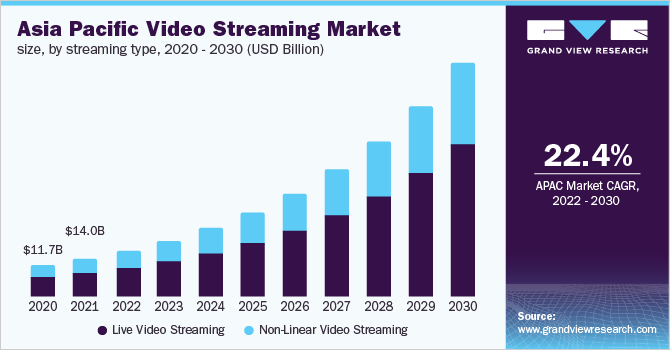

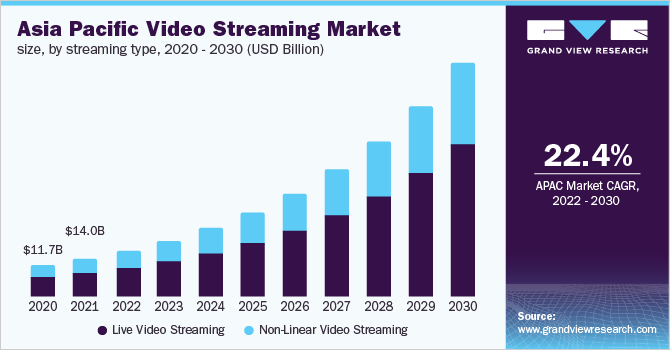

Based on the Video Streaming Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA).

- North America accounted for the largest revenue share of the video streaming market in 2021, with a 38.7% share.

- Asia Pacific is projected to demonstrate significant growth at the highest CAGR over the forecast period owing to the increasing use of mobiles and tablets, rapid technological advancements, and the popularity of online streaming.

Market Share Insights:

- March 2020: Netflix registered an increase of more than 50% in the number of new installations of its mobile application in Italy and more than 30% of that in Spain.

- July 2019: Hive Streaming, a Sweden-based enterprise video distribution company, partnered with Kaltura, Inc., a U.S.-based software company, to provide customers with premium video delivery capabilities. Under this partnership, the data visualization solutions of Hive Streaming are joined with Kaltura, Inc.’s broad network optimization offerings, including Kaltura eCDN, along with additional network optimization and video delivery solutions.

Key Companies Profile:

The key players such as Amazon Web Services, Inc.; Apple Inc.; and Netflix, Inc. dominated the global market in 2021. Vendors in the market are focusing on increasing the customer base to gain a competitive edge in the market. Vendors are adopting initiatives such as collaborations, mergers & acquisitions, and partnerships.

Some prominent players in the global Video Streaming market include

- Akamai Technologies

- Amazon Web Services, Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- Kaltura, Inc.

- Netflix, Inc.

- International Business Machine Corporation (IBM Cloud Video)

- Wowza Media Systems, LLC

- Hulu, LLC

Order a free sample PDF of the Video Streaming Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/video-streaming-market