The global wealth management software market is projected to attain USD 5.80 billion by the end 2025, according to a new report released by Million Insights. The market is anticipated to expand at a CAGR of 15.3% throughout the forecast period, 2019 to 2025. Rising digitalization and automation across various wealth management firms and financial institutions such as trading houses, asset management firms, banks, forex traders, and brokerage firms is projected to proliferate the market growth from, 2019 to 2025.

Moreover, these software are secured, efficient, and cost-effective. This factor is anticipated to impel the popularity of such software. In addition, rising number of High-Net-Worth individuals across Asia Pacific and North America is anticipated to further propel the demand for wealth management solutions.

To download the sample PDF of “Wealth Management Software Market Report” please click here: https://www.millioninsights.com/industry-reports/global-wealth-management-software-market/request-sample

These software help in easing the decision-making process while making critical investments. Moreover, they provide improved solutions by employing data analytics and extracting big data. This is further projected to fuel the wealth management software market growth. Cloud-based deployment of wealth management software is the most preferred deployment owing to flexibility and easy accessibility. Furthermore, technological advancements such as blockchain technology, artificial intelligence, machine learning, and Robotic Process Automation (RPA) are projected to revolutionize the financial-technology (FinTech) industry.

Growing need for effectively managing financial affairs and financial assets of small and medium enterprises is anticipated to drive the demand for digitized capital management solutions. Moreover, growing number of SME in North America is expected to propel the software demand across the region. Leading companies in this industry are focusing on several strategic initiatives such as M&A, product upgrades, and strategic partnership in order to expand the product portfolio and cater to increasing technological advancements.

To browse report summary & detailed TOC, please click the link below:

https://www.millioninsights.com/industry-reports/global-wealth-management-software-market

Further key findings from the report suggest:

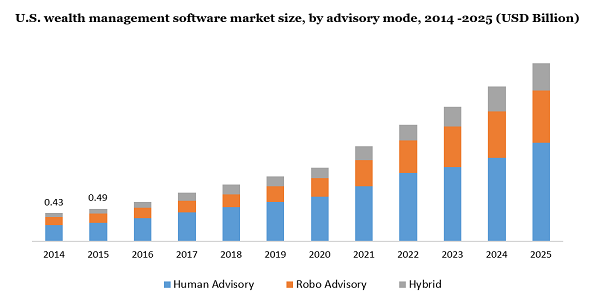

• The robo advisory segment is projected to attain the fastest CAGR of 16.0% over the forecast period owing to technological advancements such as machine learning and cognitive computing and cost-effectiveness.

• The segment of financial advice & management is expected to attain the fastest CAGR of 16.0% over the forecast period owing to rising need for managing various finances.

• The segment of trading & exchange firms is projected to attain the revenue of USD 1.01 billion by the end of 2025.

• North America led the global market for wealth management software and id projected to attain the revenue of USD 2.09 billion by the end of 2025 owing to rising population of HNW individuals in the region.

• Leading players operating in this industry include Temenos Headquarters SA; Fiserv, Inc.; Fidelity National Information Services, Inc.; SS&C Technologies Holdings, Inc.; Profile Software; SEI Investments Company; Dorsum Ltd.; Objectway S.p.A.; and Finantix, Comarch SA.

Million Insights has segmented the global wealth management software market based on advisory mode, deployment, application, end use, and region:

Wealth Management Software Advisory Mode Outlook (Revenue, USD Billion, 2014 – 2025)

• Human Advisory

• Robo Advisory

• Hybrid

Wealth Management Software Deployment Outlook (Revenue, USD Billion, 2014 – 2025)

• Cloud

• On-premise

Wealth Management Software Application Outlook (Revenue, USD Billion, 2014 – 2025)

• Financial Advice & Management

• Portfolio, Accounting, & Trading Management

• Performance Management

• Risk & Compliance Management

• Reporting

• Others

Wealth Management Software Enterprise Size Outlook (Revenue, USD Billion; 2014 – 2025)

• Large Enterprises

• Small & Medium Enterprises (SMEs)

Wealth Management Software End Use Outlook (Revenue, USD Billion, 2014 – 2025)

• Banks

• Investment Management Firms

• Trading & Exchange Firms

• Brokerage Firms

• Others

Wealth Management Software Regional Outlook (Revenue, USD Billion, 2014 – 2025)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa (MEA)

Browse the Latest Industry Research Reports Available with Million Insights:

• Antibacterial Products Market – The global antibacterial products market was prized by USD 27.04 billion in 2020. It is estimated to witness 2.3% CAGR from 2021 to 2028.

• Silicone In Car Care Products Market – The global silicone in car care products market was prized by USD 216.9 million in 2020. It is estimated to witness 3.2% CAGR from 2021 to 2028.

About Million Insights

Million Insights, is a distributor of market research reports, published by premium publishers only. We have a comprehensive market place that will enable you to compare data points, before you make a purchase. Enabling informed buying is our motto and we strive hard to ensure that our clients get to browse through multiple samples, prior to an investment. Service flexibility & the fastest response time are two pillars, on which our business model is founded. Our market research report store, includes in-depth reports, from across various industry verticals, such as healthcare, technology, chemicals, food & beverages, consumer goods, material science & automotive.

Media Contact

Company Name: Million Insights

Contact Person: Ryan Manuel

Email: Send Email

Phone: 91-20-65300184

Address:Office No. 302, 3rd Floor, Manikchand Galleria, Model Colony, Shivaji Nagar

City: Pune

State: Maharashtra

Country: India

Website: https://www.millioninsights.com/industry-reports/global-wealth-management-software-market