Bengaluru – EnKash, a corporate spend management startup, that recently raised $20 million in a new round of funding led by Ascent Capital, including Baring India Private Equity Partners and Singapore-based White Ventures, endorsing the vision of the startup to continue disrupting the business spend management space. The funding round was also attended by their existing backers in Mayfield India and Axilor Ventures.

Currently, services provided by the fintech startup are an all-in-one spend management platform for businesses with core product offerings, include end to end payable, receivable & expense management, and issuance of corporate cards. According to the Mumbai-based company, it will use the funds to expand its offerings around banking as a service by increasing its ‘plug and play’ cards issuance stack and geographical presence, among other things.

In an interview with ET, Co-founder Hemant Vishnoi said, “We intend to expand our presence globally, with the current investment. The majority of the investment will also go into product and technology development, hiring, and scaling up in India. We will also continue to expand our presence in the Indian market.” According to him, the corporate spend management market in India is worth $500 billion per annum.

He further added, “The reward programs, which we started on the non-financial side, allow us to ensure that special discounts are offered to EnKash customers who avail services from us. In addition, there are other products that are in the beta stage of development.” EnKash intends to improve the experience and accessibility of financial and non-financial products for businesses through a variety of initiatives.

When it comes to BNPL, abbreviated as Buy Now Pay Later transactions, the average ticket size at EnKash is approximately Rs 10-12 lakh, while normal transactions are approximately Rs 5-6 lakh. EnKash currently has an annualized spend rate of approximately $2 billion on average.

EnKash has more than 70,000 businesses and has issued over 550,000 cards. It had previously raised $3 million in Series A funding in 2019, with Mayfield and Axilor Ventures serving as lead investors. As evident, Axilor Ventures provided the initial seed funding for the company.

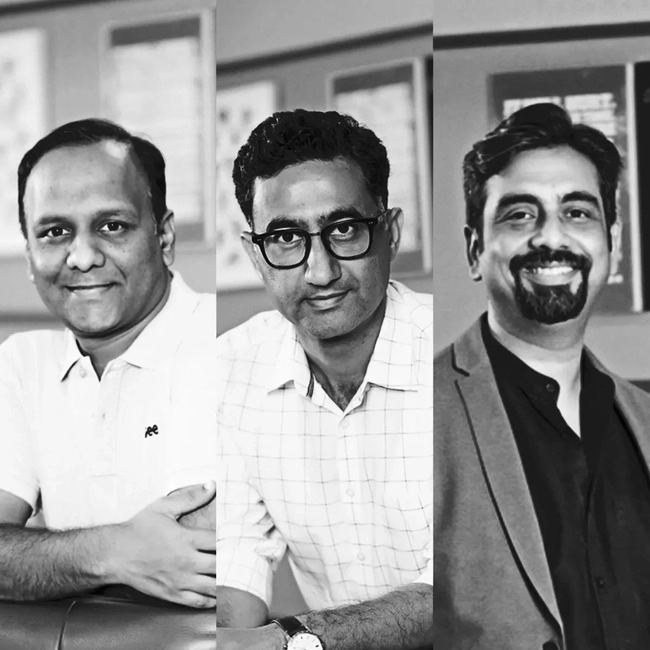

“To date, we have distributed more than 550,000 corporate cards. In addition, our purchase cards are typically similar to those offered by BNPL. As of now, the company has formed partnerships with three nonbank financial institutions,” co-founder Naveen Bindal explained. EnKash became operational in 2018 and was founded by payments & cards industry veterans: Naveen Bindal, Hemant Vishnoi, and Yadvendra Tyagi.

Bindal was quoted as saying, “the small to medium-sized businesses require better experience and accessibility of financial & non-financial products with the growing market.” The company focuses on small and medium-sized enterprises (SMEs) and businesses with revenues between Rs 10 crore and Rs 1,000 crore, which come with their inherent characteristics & challenges.

To learn more visit: https://www.enkash.com/

Media Contact

Company Name: EnKash

Contact Person: Aman

Email: Send Email

Country: India

Website: www.enkash.com