Buy Now Pay Later Industry Overview

The global buy now pay later market size was valued at USD 5.01 billion in 2021 and is expected to reach USD 39.41 billion by 2030, registering a CAGR of 26.0% over the forecast period. Buy Now Pay Later (BNPL) is a payment option that allows customers to make purchases online and at stores without having to pay the complete amount upfront. Factors fueling the growth of the market include digitization, increasing merchant adoption, the growing repeat usage among younger consumers, and the introduction of new players offering lending through BNPL services. Younger consumers prefer using BNPL services as it provides several benefits, such as buying high-cost laptops and smartphones and making payments for stationery products.

Numerous players are focusing on developing and launching an interest-free BNPL installment solution that enables the customer to pay in installments. Such product launches are aimed to provide a better customer experience to the customers. For instance, in August 2020, PayPal Holdings, Inc. announced the launch of its interest-free buys now pay later installment solution called Pay in 4. This solution enables partners and merchants to get paid upfront while enabling customers to pay for purchases ranging from USD 30 to USD 600 over six weeks. Through this launch, the company expanded its product portfolio.

Gather more insights about the market drivers, restrains and growth of the Global Buy Now Pay Later Market

BNPL services offer a fixed payment schedule, simplified checkout process, zero interest, and fast approval options to customers looking to make purchases. Consumers across the globe use BNPL services to avoid paying credit card interest, make purchases that don’t fit in their budget and borrow money without a credit check. According to a survey by ZestMoney, in January 2022, BNPL emerged as the preferred solution for people across different age groups in 2021, with the youngest consumer being 18 years old and the oldest at 66. The survey also found that men from tier 1 and 2 cities spent heavily on lifestyle and fashion, and women from tier 1 and 2 cities spent on upgrading their edtech courses for upskilling and electronics.

Technological advancements coupled with the notable increase in internet penetration globally have enabled financial service providers to offer novel digital services to customers. The rising popularity of mobile-based apps for making payment transfers also propels the demand for internet banking. Moreover, the strong growth of the e-commerce sector has helped fintech companies to develop their footprints for BNPL solutions worldwide. For instance, the Amazon Pay Later services offered by Amazon.com, Inc., have more than two million users in India and have already been used by more than 10 million times since its launch in April 2020.

Higher smartphone adoption and the requirement for faster internet connectivity have propelled merchants and customers to receive and make payments via the digital platform. In addition, the BNPL platform also supports the QR-code option that allows the customers to scan the code and make respective payments. However, high late fees charged by BNPL service providers are expected to hinder the market growth over the forecast period. Moreover, credit providers and banks that offer BNPL services place charges on both the merchant and the customer.

Buy Now Pay Later Market Segmentation

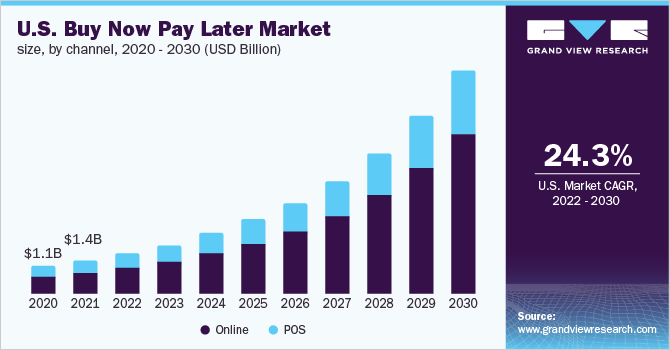

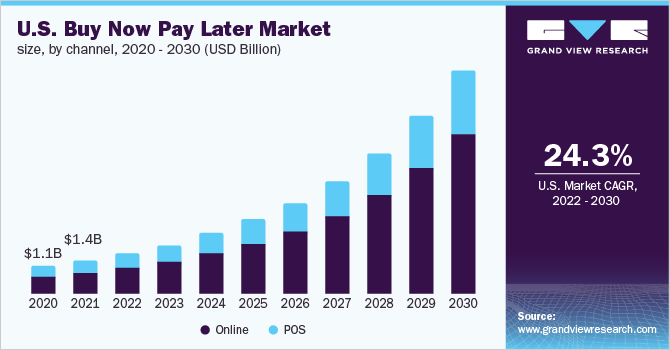

Based on the Channel Insights, the market is segmented into Online, and POS.

- The online channel segment dominated the market in 2021 and accounted for the largest share of more than 64.0% of the global revenue.

- The PoS channel segment is anticipated to witness a significant growth rate over the forecast period. Many businesses are focusing on providing PoSBNPL financing options to enhance customer experience and strengthen their relationship with customers.

Based on the Enterprise Size Insights, the market is segmented into Large Enterprises and Small & Medium Enterprises.

- The largeenterprises segment dominated the market in 2021 and accounted for more than 61.0% of the global revenue share. Large-scale enterprises are widely adopting BNPL payment solutions as they offer customers a flexible and affordable payment method for purchasing high-value products.

- Small & medium enterprises focus on increasing their customer base and strengthening their position in the market. As a result, the adoption of BNPL solutions is expected to increase among SMEs, thereby supporting the growth of the segment.

Based on the End-use Insights, the market is segmented into Consumer Electronics, Fashion & Garment, Healthcare, Leisure & Entertainment, Retail, and Others.

- The fashion & garment segment dominated the market in 2021 and accounted for the maximum share of more than 43.0% of the global revenue. The industry is witnessing increased adoption of BNPL solutions as they allow customers to easily distribute the cost of the purchase over a time of pre-determined and interest-free payments.

Based on the Buy Now Pay Later Regional Insights, the market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

- The consumer electronics segment is anticipated to register a promising CAGR over the forecast period. The industry is witnessing an increasing adoption of BNPL payment methods as they offer a low-friction substitute to credit cards.

- North America dominated the market in 2021 and accounted for the highest share of around 30.0% of the global revenue. The regional market growth can be attributed to the presence of a large number of prominent players.

- Asia Pacific is anticipated to record the fastest CAGR over the forecast period. BNPL trend is becoming popular across the region as it enables customers to access credit and defer payments.

Browse through Grand View Research’s IT Services & Applications Industry Research Reports.

- Property Management Software Market – The global property management software market size was valued at USD 3.04 billion in 2021 and is expected to exhibit a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030. The market is expected to witness an incremental surge in demand for Property Management Software (PMS) owing to escalating demand for web-based services including Software as a Service (SaaS) by property management software providers.

- Business Software And Services Market – The global business software and services market size was valued at USD 429.59 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 11.7% from 2022 to 2030. The growing volume of enterprise data and increased automation of business processes across industries such as retail, manufacturing, and healthcare are driving the market growth.

Market Share Insights:

- January 2022: Affirm Holdings Inc., BNPL service provider for the consumers, launched two significant product suites: Chrome browsers extension and Affirm SuperApp. SuperApp provides advanced BNPL options for payments, shopping, and financial services with one easy-to-use solution.

- December 2021: Afterpay Limited announced a partnership with Rakuten to accumulate shopping rewards after using its BNPL service. This partnership is expected to combine shopping experience and payment methods for gathering a larger consumer base. Cashback and incentives will be integrated into this partnership.

Key Companies Profile:

The market is moderately fragmented. BNPL is a useful service for both customers and merchants. Prominent providers, making their way toward the e-commerce ecosystem by expanding their footprints and acquiring new customers. Some of the prominent players in the global buy now pay later market are:

- Afterpay

- PayPal Holdings, Inc.

- Affirm, Inc.

- Klarna Inc.

- Splitit

- Sezzle

- Perpay Inc.

- Openpay

- Quadpay, Inc.

- LatitudePay

Order a free sample PDF of the Buy Now Pay Later Market Intelligence Study, published by Grand View Research. About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research Helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Web: https://www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/buy-now-pay-later-market-report