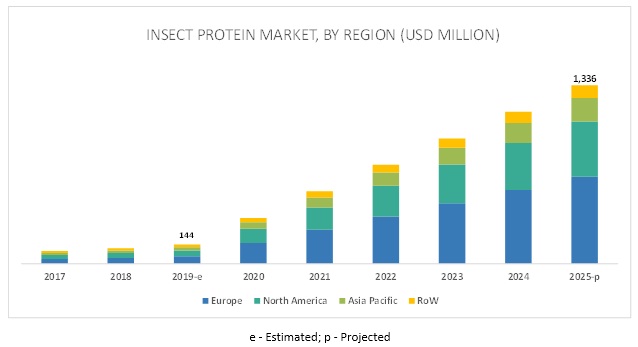

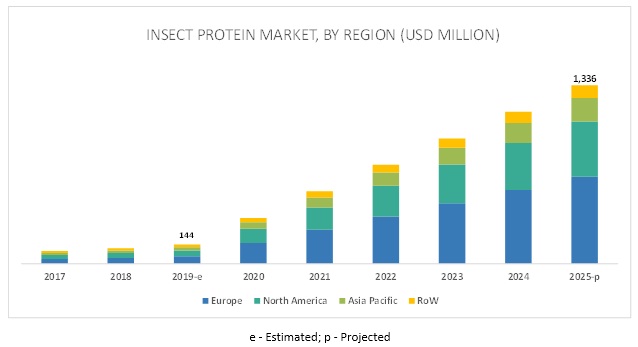

The insect protein market is projected to reach USD 1,336 million by 2025, from USD 144 million in 2019, at a CAGR of 45.0 % during the forecast period. Factors driving the market include the shift in preferences from animal protein to alternative proteins such as insect protein due to the increased concerns over future sustainability, and increased public and private support for new insect protein research projects in both developed and developing economies.

High acceptance of crickets in the food industry due to their high protein content

Due to the high availability and acceptability of crickets and their high protein content, their usage in products, such as protein bars, is very high. Dried cricket powder contains 69% of protein, compared to sirloin beef (29%), dried beef (43%), and chicken (31%). It also contains nine essential amino acids, along with zinc, Vit. B12, iron, potassium, magnesium, sodium, and calcium. Also, cricket flour acts as an alternative for milk, as it contains a high amount of calcium. The use of crickets is profitable in comparison with other livestock proteins, owing to the reduced expenses associated with rearing crickets. Crickets usually require around 2 kg of feed to produce 1 kg of meat, in which around 80% is edible, whereas, cattle require 8 kg of feed to produce the same amount of meat, out of which only 40% is edible.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=150067243

Collaborations between insect protein-based product manufacturers and retailers to increase visibility and awareness

Higher costs and visibility of insect protein-based products have been some of the major problems for the companies. Many start-ups have been selling these products majorly through online channels. However, due to the increasing awareness regarding the benefits of insect protein and to increase the visibility of insect protein-based products, many companies have started collaborating with retail chains and other convenience stores. For instance, Eat Grub, a UK-based insect protein-based product manufacturer, collaborated with SOK—one of Finland’s largest supermarket groups. SOK would be selling Eat Grub’s products in 400 of its stores. In another instance, insect-based snacks French start-up, Jimini’s, secured a listing with Carrefour, a multinational retailer, to supply items to 300 of its stores. Jimini’s intends to educate and increase awareness regarding insect protein as a future sustainable source for proteins by selling insect-based products in retail stores. Thus, to increase visibility, awareness, and the sales of insect protein-based products, start-ups such as Eat Grub (UK) and Aspire Food Group (US) are collaborating with retail stores, which can be a strategic step to develop the insect protein industry.

North America and Europe dominated the insect protein market in 2018

Insects have been an integral part of the traditional diet in Southeast Asian countries; hence, the adoption of processed products such as insect protein in these countries has been low. The number of players venturing into this market has been high in Europe and North America. Majorly, countries such as France, the Netherlands, Germany, and the US have been accepting these products, Moreover, the recognition of insect protein as novel foods in the European and US markets and the legislative amendment to include insects as a part of feed and food material have boosted the growth opportunities for insect protein in these countries. Majority of the manufacturers are headquartered in these countries and, being small-scale players; their revenues are majorly concentrated in the domestic market. Thus, the market shares of North America and Europe dominated the global market in 2018.

This report includes a study of the development strategies, along with the product portfolios of the leading companies. Insect protein finds major applications in the food and feed industries, and hence, profiles of the major manufacturers of insect protein products for both food and feed applications have been covered in this report. The key companies in the insect protein market for food application include Aspire Food Group (US), EntomoFarms (Canada), Protifarm (Netherlands), Jimini’s (UK), Chapul Cricket Protein (US), and Swarm Nutrition GmbH (Germany) while the key companies for the insect protein market the feed application include AgriProtein Holdings Ltd. (South Africa), EnviroFlight LLC (US), Innovafeed (France), Ynsect (France), Hexafly (Ireland), and Protix (Netherlands).

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=150067243

Critical questions the report answers:

Where will all these developments take the industry in the mid-to-long term?

What are the upcoming commercial prospects for the insect protein market?

What is the impact of other alternative protein ingredients on the insect protein market?

What are the new insects introduced in the insect protein market?

What are the latest trends in insect protein market?

Media Contact

Company Name: MarketsandMarkets

Contact Person: Mr. Shelly Singh

Email: Send Email

Phone: 1-888-600-6441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/insect-protein-market-150067243.html