Those paying attention to the metals markets know this: gold prices are soaring. As the precious metal’s price per ounce reaches multi-year highs, some say it is on track to eclipse record levels above $2075 this year. Of course, the rally is more than good for those holding the commodity; it is also for investors looking to leverage the strength of others to maximize the upside while mitigating risk. In other words, the best way to play the bull market may be to identify the companies that plan to capitalize on high gold prices by operating in areas with compelling and proven assets. iMetal Resources, Inc. (OTC: IMRFF) (TSXV: IMR) makes that list for consideration, and for excellent reasons.

Foremost is that IMRFF is advancing its mission to exploit value from its assets through one of the most proven gold-mining locations in the world: the Abitibi Greenstone Gold Belt. Though location can be critical, it isn’t the only factor needed to drive value. Companies also need the capital to develop assets, and that’s another box IMRFF checks.

Despite its microcap price, iMetal Resources is better positioned than many, with cash on hand to expedite its 2023 exploration initiatives. And given that thinly-traded IMRFF stock historically surges when investors focus on its potential, a confluence of factors could make the path of least resistance higher for the remainder of this year.

An Under-the-Radar Gold Stock Opportunity

Though speculative, a continued trend higher would follow precedent. iMetal’s U.S. shares surged 387% from their low of $0.05 in October 2022 to $0.24 in February. While shares have given back some of that gain, trading at $0.16* today, and with gold in a technical rally mode, the IMRFF bulls still have a tailwind to generate appreciable gains, realistically targeting its 52-week high of $0.30 by being better positioned today than when it scored that price. (*share price on 5/22/23, Yahoo! Finance, $0.16 at 11:47 AM EST)

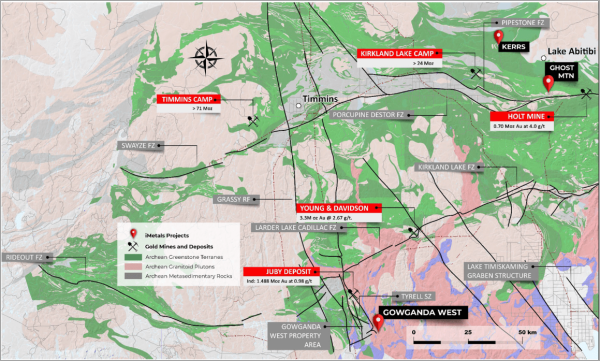

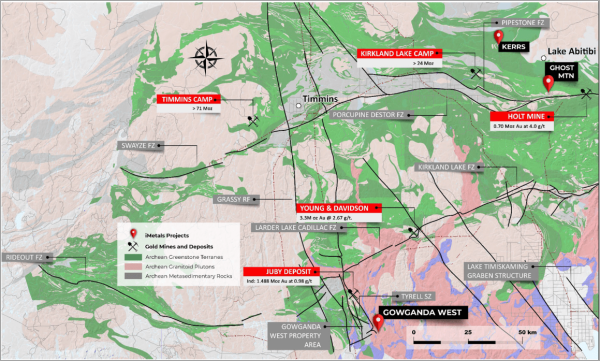

Numerous factors support optimism. The most compelling is that iMetal Resources Inc.’s projects are strategically located within Ontario’s renowned Abitibi Greenstone Gold Belt, a region globally recognized for its immense gold reserves. The value inherent is no secret – in fact, it’s expected. Industry giants, including Newmont Corp (NYSE: NEM) and Agnico Eagle (OTC: AEM), have residencies there, supporting the bullish thesis about the area as it contributes to their approximately $34.5 billion and $26.75 billion market caps, respectively, on May 19th. For IMRFF investors, considering that its projects are close to those sector behemoths and the value those companies accrued from them, under-appreciating iMetal’s opportunity may prove costly.

Keep in mind that even underground assets can accrue to a company’s balance sheet. Therefore, proving a prospective area’s viability can catalyze unprecedented growth, particularly for smallcaps like iMetal Resources Inc. Expected updates could fuel that likelihood, and those developments could already be in the queue.

Updates From Ongoing Projects Could Fuel A Rally

One could be related to its projects at Gowganda West, where additional updates could put a significant upside in play. The discovery of high-grade gold and silver deposits already indicates potential accrued value inherent to further exploration and resource expansion. This location alone presents ample opportunities for value exploitation, and news from last week supports tapping into it quickly. Specifically, iMetal announced completing its 2023 Phase 1 drilling at the project, drilling seven holes totaling 2,490 metres, and was a follow-up on the 2022 fall drill program, as well as the 2019 VTEM airborne survey. Remember, this asset lies within the prolific Abitibi Greenstone Gold Belt.

The even greater news is that IMRFF is designing its flagship Gowganda West project to tap into underexplored territories. In other words, while its primary focus remains to identify gold trends proximal to the Juby deposit, testing the first of the 2019 VTEM anomalies to the northeast could lead to finding significant value in the Abitibi location, even a new discovery.

To expedite seizing that potential, iMetal engaged Laframboise Drilling Inc. of Earlton, Ontario, for its current phase of drilling at Gowganda West, with samples submitted to ALS Geochemistry in Sudbury for assaying. The intent of this phase of drilling is focused primarily on further delineating trends near the border with Aris Mining and, as noted, testing a VTEM target from the 2019 airborne program. Plans are currently being drawn for the next phase of 2023 exploration ahead of receiving what’s expected to be positive assay results from the completed drill program.

Under The Radar Despite Exploring A Massive Proven Gold-Rich Location

Indeed, at current prices and factoring their assets in development, IMRFF is flying under investors’ radar. That’s surprising, considering the company has positioned itself to access metals from Canada’s most productive and renowned gold districts, namely the Abitibi Greenstone Belt in Ontario and Quebec. Another factor to consider is that IMRFF benefits from exploration and development cost efficiencies from these locations’ logistical ease of access, resulting from Canada’s mining-friendly policies and well-established infrastructure that facilitate cost-effective exploration for mining companies and industry stakeholders.

Moreover, Canada’s reputation for having the most transparent and efficient permitting process aligns harmoniously with its balanced environmental and safety regulations, creating an ideal environment for companies such as iMetal Resources Inc. to monetize assets and leverage an abundance of available skilled labor, including experts in cutting-edge technologies that are revolutionizing exploration methods that provide substantial cost savings for companies.

More simply, Canada is an ideal working partner, so to speak, enabling iMetal to take advantage of mineral wealth in the Abitibi Greenstone Gold Belt. Better still, it’s a relationship that can help expedite IMRFF’s plans to leverage its unique assets and turn ambition into dollars.

Exploiting Value From Abitibi Greenstone Gold Belt

It’s a well-supported presumption. Remember, the Abitibi Greenstone Gold Belt, spanning Ontario and Quebec, is a massive geological formation that has long been recognized as one of the world’s richest gold-bearing regions. Additional benefits to those investing resources in the area include aligning with mining-friendly jurisdictions, excellent infrastructure, and a history of successful mining operations. The Abitibi Greenstone Gold Belt spans roughly 700 kilometers from east to west. It is best known for holding abundant mineral deposits, particularly gold, but also silver, copper, and zinc. The region has proved its worth to date, giving up and/or signaling over 200 million ounces of gold, 400 million ounces of silver, 15 billion tons of copper, and 35 billion tons of zinc.

Those deliverables and potentials have led Ontario’s mining belts to provide miners a rich history of success, with over 100 producing mines in the region extracting what they can as fast as possible. Of those established mines, 21 are classified as distinct gold deposits, each boasting over 3 million ounces of the shiny metal.

While impressive data to date, companies investing in the region expect to uncover much more; many are investing significant capital in unearthing the mother lode of value they believe is still unearthed. The best news about IMRFF is that they are not a single-opportunity company; they have at least three shots at potentially massive value-creating goals.

Three Projects Present Diversified Value-Creating Opportunity

IMRFF is currently focused on maximizing the value of each of its mining projects, holding stakes in Gowganda West, Kerrs Gold Deposit, and Ghost Mountain. Each presents a unique opportunity to capitalize on the region’s abundant mineral wealth, and more importantly, from an investor’s perspective, are assets to be considered when trying to appraise fair value. At current prices, the worth of those assets has yet to be fully considered.

However, the disconnect between share price and inherent value may not last long – a premise significantly supported by the Gowganda West project. It’s contiguous to the west and north of Aris Gold’s Juby deposit, a recognized gold deposit that has attracted significant exploration and development interest. Notably, it’s also contiguous to the west and northwest of Agnico Eagle and Orefinders Resources’ mining properties, spanning 147 square kilometers and located just 90 minutes by road from the renowned mining hub of Kirkland Lake. The project boasts road access, crucial for efficient exploration and development activities. There’s more to like.

A compelling feature of the Gowganda West project is its contiguous location with Aris Mining (TSX: ARIS), which hosts the envied Juby deposit. The Juby deposit has been identified as hosting 770,000 ounces of gold (Indicated) at 1.1 grams per tonne (g/t) and an impressive 1.5 million ounces at 0.98 g/t (Inferred). What’s great for them can be excellent for IMRFF. The geological structures hosting the Juby deposits have been observed to trend onto iMetal Resources’ ground, strengthening its belief they are on the right track for a gold strike.

A second potential to generate value is inherent to the Kerrs Gold Deposit, characterized by quartz vein replacement breccia gold mineralization, a style of deposit in which gold-bearing quartz veins are emplaced within brecciated host rocks. This type of gold deposit is known for its potential to host high-grade gold mineralization. Moreover, the Kerrs Gold Deposit benefits from a 43-101 Historic resource, indicating that a significant amount of exploration work has already been completed on the property. New technologies provide incentive and potential for IMRFF to exploit work done and capitalize on an opportunity showing tremendous promise from being located near the south and west of Newmont Corporation, one of the world’s largest gold producers.

Finally, there’s Ghost Mountain, another promising asset close to Agnico Eagle’s Holt and Holloway Mine. Because it’s close to a major mining operation, iMetal is provided valuable insights into the geological characteristics of the area and access to existing infrastructure. Like the others, the Ghost Mountain project offers significant exploration potential and a potential near-term shot on goal in taking advantage of its strategic location to uncover new gold deposits.

Assets And Projects Supportive Of Near And Long-Term Growth

All told, single parts of iMetal’s asset portfolio can justify and support appreciably higher prices. However, appraising IMRFF that way leaves significant intrinsic value to be recognized. iMetal Resources is more appropriately valued on a sum-of-its-parts basis, especially with each part presenting a considerable opportunity for near-term success by being located at one of the world’s most proven locations for gold and other metals.

But, as mentioned earlier, IMRFF is apparently under the radar of many gold sector investors. Now, that’s not necessarily bad news because it does keep an opportunity at ground-floor prices in play. And after learning more about IMRFF, even skeptics will find it challenging to argue against the company is better positioned than ever to reclaim 52-week high prices that are 87% higher than current. Considering that IMRFF is in a solid financial position, leverages an experienced team, and has top-grade assets in its portfolio, that bullish trajectory may be more than likely; it’s probable.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC. Has been compensated up to ten-thousand-dollars via cash wire by a third party to produce and syndicate content for iMetal Resources, Inc. for a two-week period ending on May 12, 2023. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting primetimeprofiles.com/disclaimers. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/