What a run it has been the last several years with most Colorado ski resorts averaging 30-40% / year increases. Many resort areas are still up double digits for the year, but just like the seasons are beginning to change there is a cold bite to the air in Colorado ski real estate. Which markets are performing the best now and which ones will perform the best in the future. The recent data from the peak tells an interesting story.

Where did I get my data

To ensure I am comparing apples to apples, I use the data published by the Colorado association of realtors by county/metro area. The data is reported the same throughout the state so I can easily compare areas along with time periods.

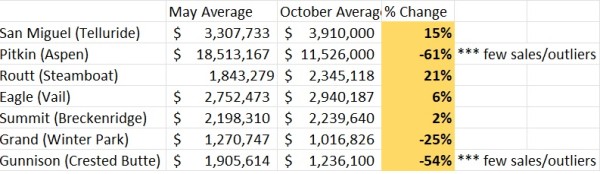

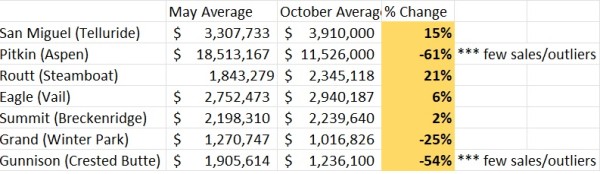

For this analysis I picked May and October (this is the most recent data as of the writing). The reason I picked May is that is somewhere near the peak of the market and rates really started changing after that and accelerating into the fall.

Use the data with caution, but big trends can be picked out

When looking at ski real estate, in many mountain markets there are not a ton of transactions. For example in Aspen in one month I reviewed there were 5 sales of single family homes. Telluride and Crested Butte also have limited data. With limited data on a month-to-month basis there can be huge swings.

Even in places like Breckenridge and Winter Park where there are more sales data can be skewed due to huge sales either direction. For example, if a 20 million dollar ranch sold outside of Winter Park, this would drastically alter the data in one month vs. another. The same is true for every ski town as there can be multiple huge sales as outliers. Aspen and Telluride have the most of these with multiple sales topping 25m+. Note, I did the same analysis with median prices, but there was even more noise due to these large transactions that pulled the data one way or another.

How does Denver compare to the ski resorts:

Denver has ample sales, so the data is not skewed by a few closings. For the same period Denver is down. There is no doubt that the current real estate slump in Denver is not the normal fall cycle. The average home price is off 2% and inventory has more than doubled. Median price has also fallen 11% since May which is a better indicator for Denver due to the large number of transactions.

Denver is going through a correction that likely will accelerate as rates continue to rise. It is important to note that Denver drives values in closer in resorts as it is not far for someone to own a home in Denver and go up to Breckenridge for the weekend. Here is the most recent data on Denver as of this writing. Inventory is rapidly increasing coming close to the inventory of October 2019 of single family homes.

Which are the top two ski town investments

Both Telluride and Aspen have allot in common. Both are land constrained, build costs are high, there are very few, if any, available lots, and most importantly they are seen as a hedge to inflation. In a high inflation environment, high net worth buyers are scrambling to “protect” their assets. In a typical market as the stock market fell, you could hedge with treasuries or international exposure, but in the current environment everything is falling so hard assets like real estate are one of the few “safe havens”. Furthermore, neither market has a high correlation with another market. For example, what happens in Denver doesn’t have much if any impact on either market as the buyers come from all over the country and world. Both Telluride and Aspen meet these characteristics.

It is important to note on the data above that Aspen is not really falling like the data shows. There is a softening like every other market, but a few large sales have skewed the May numbers as opposed to October. On the flip side in Telluride due to the small number of transactions the data is extremely choppy. Rest assured both are excellent long-term investments. Both Telluride and Aspen tie for my top picks. The best one for you depends on your personal preferences. There is a common saying that people go to Aspen to be seen and people go to Telluride to not be noticed.

Why are Summit and Grand under-performing?

Both Summit (Breckenridge) and Grand (Winter Park) have a very high correlation to Denver due to their proximity to the metro area. As prices soften in Denver, this impacts second home purchases in places like Breckenridge and Winter Park more than markets like Steamboat or Vail as they are “drive up” markets.

Summit County: Summit county is still up for the year and has had an amazing run basically doubling since 2019. The market has definitely changed; gone are the days of 40% appreciation to basically flat. This is not due to the nightly rental regulations as the statistics I am using are single family homes to factor the noise out from the condo/townhome market. There is no doubt that after an unbelievable runup in prices that Summit county is cooling quickly. Historically, Summit County has a higher correlation to Denver so as Denver cools so does Summit County. It appears these historical trends are holding true in this cycle. Look for more downward pressure on prices the remainder of this year into next.

Grand County: Winter Park is also softening but I don’t think it is softening quite as severely as the data suggests. Winter Park does not have a ton of sales so the data is likely choppy from month to month. But the general direction of downward price pressures is accurate as Winter Park has the highest correlation to Denver due to its proximity and price points. I expect Grand County to continue cooling as rates begin to bite and Denver continues its downward trend.

Why are Steamboat and Vail outperforming others?

Both Steamboat and Vail have a much lower correlation to the Denver metro area and draw buyers from throughout the country. Furthermore, Vail has a large international buying pool. Having a much larger pool of buyers helps smooth out the ups and downs in the market. I think this trend will continue and that Steamboat and Vail will outperform other markets due to the broader buying pool.

What about Crested Butte

It is hard to read too much into the data in Crested Butte due to the limited number of transactions a month. I suspect Crested Butte will perform more like Steamboat and Vail due to its distance from the Denver metro and lower correlation to the front range. Furthermore, Crested Butte is owned by Vail resorts so during a downturn Vail will continue investing in the mountain which should further help real estate.

Summary

There aren’t any “bad” ski towns in Colorado. Every Colorado ski town is basically land locked and building costs are high which will limit new inventory coming online. But if I had to rank them in order based on today’s economic environment Telluride and Aspen would tie for the top place followed by Vail/Steamboat/Crested Butte. Long term all the Colorado ski areas will outperform most other real estate throughout the country so none of these markets would be a bad long-term investment.

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates.

Media Contact

Company Name: Colorado Hard Money

Contact Person: Glen Weinberg

Email: Send Email

Phone: +1-303-835-9376

Country: United States

Website: www.coloradohardmoney.com